What to do if you receive an IRS balance due notice for taxes you have already paid.- TAS

$ 15.50 · 4.6 (396) · In stock

IRS Threatens Coloradans Who Already Paid Taxes: 'They're Frightened And They Don't Understand' - CBS Colorado

What to do if you receive an IRS balance due notice for taxes you have already paid.- TAS

I Don't Have My Refund - TAS

Can TAS help me with my tax issue - Taxpayer Advocate Service

I Got My Refund - What is the payment for? IRS TREAS 310 + TAX REF, TAXEIP3 or CHILDCTC explained. -tip-got-a-direct-deposit-from-the-irs-but-not-sure-what-it-is-for/

How the IRS Determines the Statute of Limitations on Collections - CPA Practice Advisor

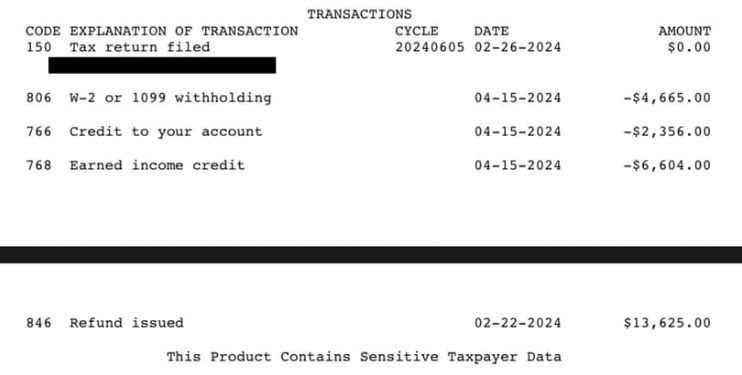

IRS Transcript Codes And WMR Reference Codes

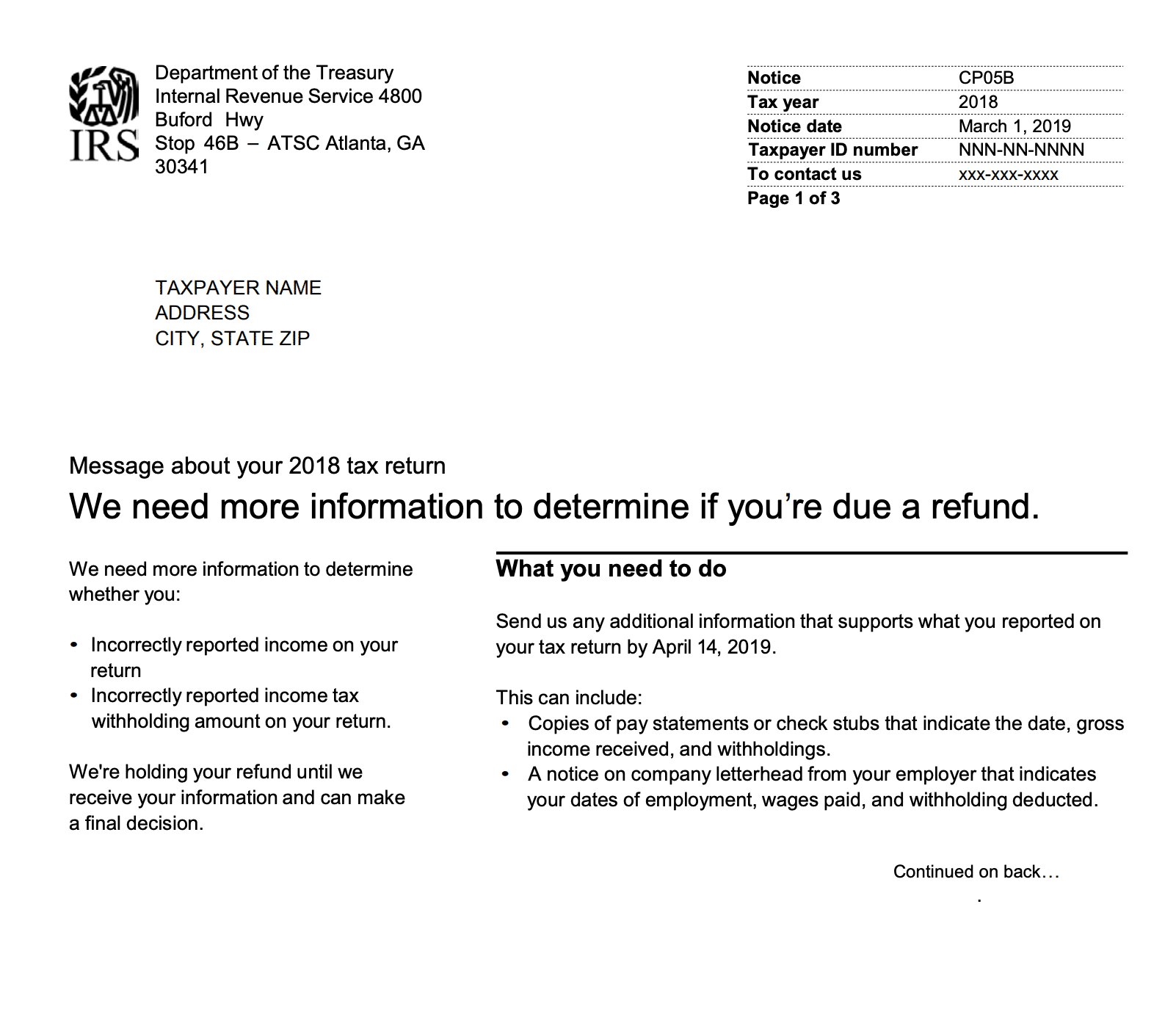

What Is a CP05 Letter from the IRS and What Should I Do?

TAS Tax Tip- Notice from IRS Something wrong with 2022 tax return

Tax Tip: I got a notice or letter from the IRS - now what do I do? - TAS

Instructions for Form 9465 (11/2023)