10-year Treasury yield dips to new 2016 lows further below 2%

$ 19.99 · 4.6 (475) · In stock

.1562153928810.png?w=929&h=523&vtcrop=y)

The yield on the benchmark 10-year Treasury note fell to its lowest level since November 2016 on Wednesday, continuing its slide below 2%.

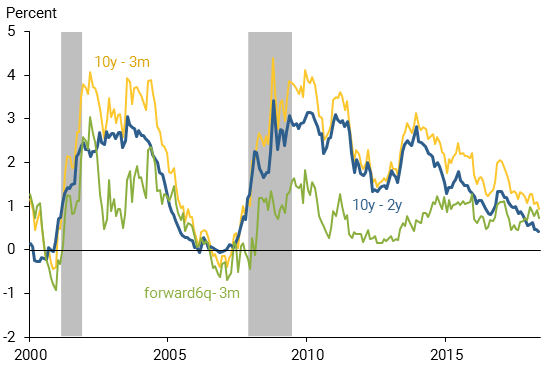

Information in the Yield Curve about Future Recessions - San Francisco Fed

Will rising yields sideswipe equities? – Humble Student of the Markets

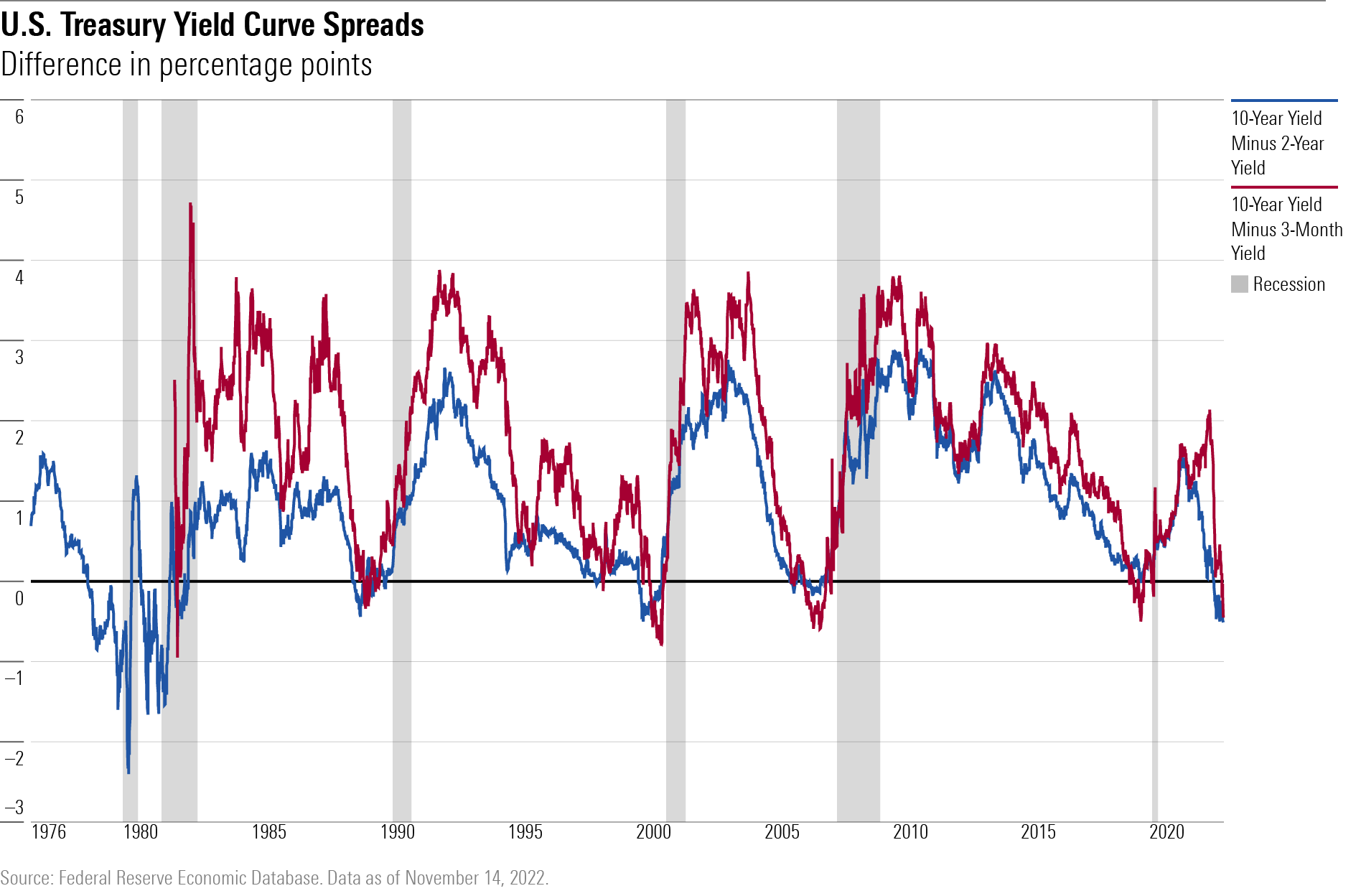

How true is it when Yield spread on US 2-year and 10-year treasuries is getting flat. When it inverts, history says a recession usually follows? - Quora

Weekly Market Commentary

:max_bytes(150000):strip_icc()/ES1_2023-10-03_08-21-39-71f0b8eb75114336a10f0838425e79e3.png)

Markets News, Oct. 3, 2023: Dow, S&P 500 Fall to 4-Month Lows as Bond Yields Rise on Jobs Data

10-year treasury yields steadily declined for nearly 40 years, bottoming out in 2020 at under 1%. But now yields are on the rise. Is this trend part of a long-term credit/debt cycle

The US Treasury Yield Curve Recession Indicator is

The Daily Shot: The 30-Year Treasury Yield Dips Below 2% for the First Time - WSJ

Inverted Yield Curve History Should Worry Bulls - RIA

Weekly Market Commentary

Treasury Yield-Curve Inversion Reaches a Four-Decade Extreme - Bloomberg

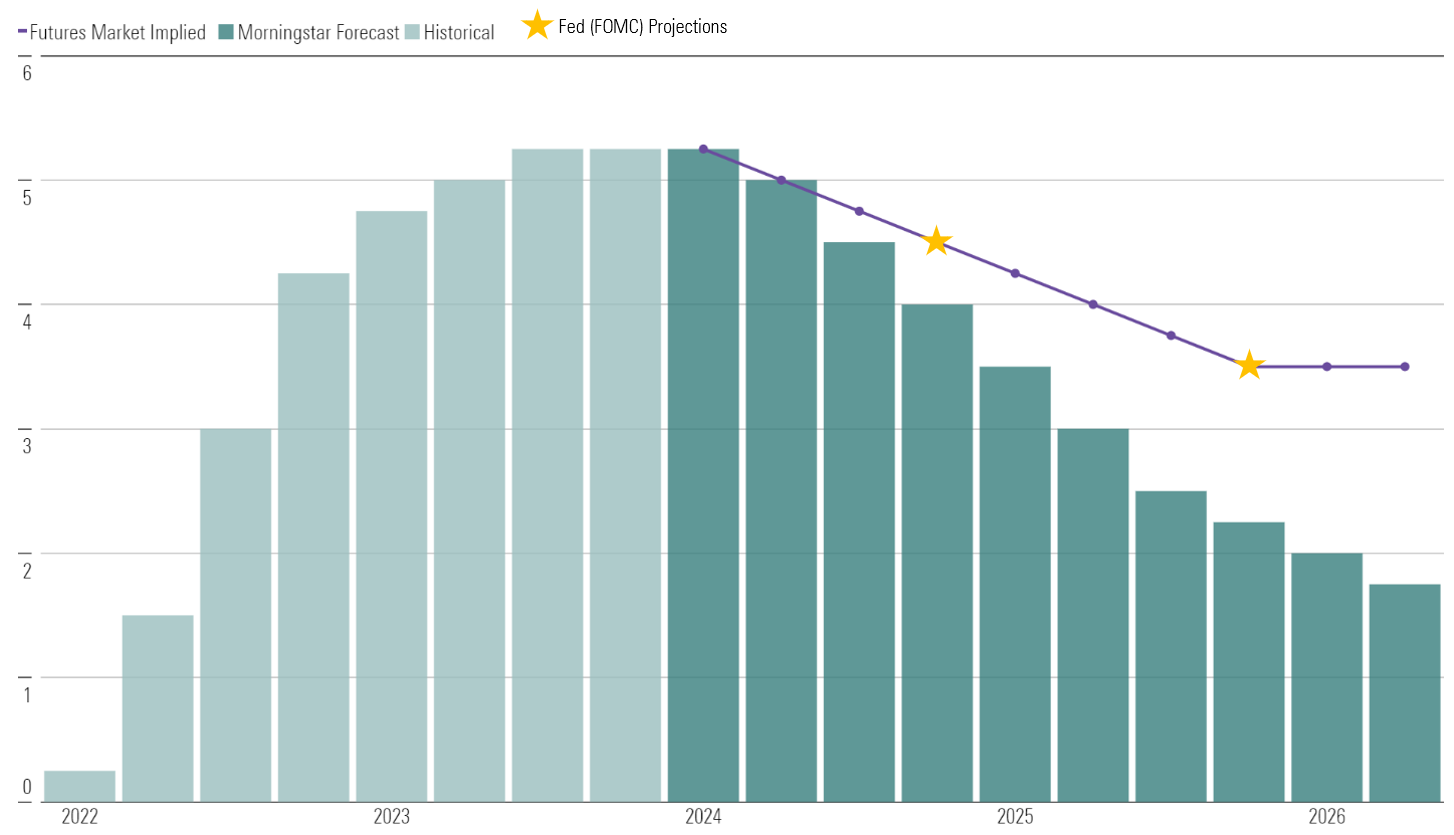

Higher for Longer Inflation & Interest Rates Not Over Until the Fat Lady Sings? Waiting for the 2-Year Treasury Yield to Overshoot

When Will the Fed Start Cutting Interest Rates?