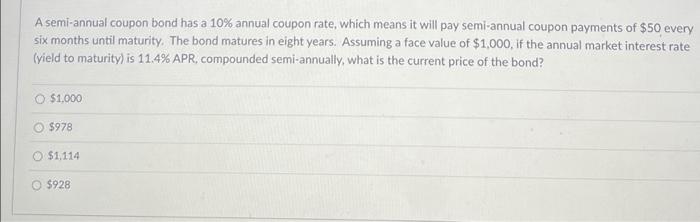

Solved A semi-annual coupon bond has a 10% annual coupon

$ 18.99 · 4.6 (569) · In stock

QUESTIONS TO BE ANSWERED-1.docx - 1. 2. 3. 1. 2. 3. ABC has issued a $1000 par bond with 25 years to maturity 7% coupon rate and semi-annual payments.

Solved] 2.1 (4 points) How does the equation for valuing a bond change if

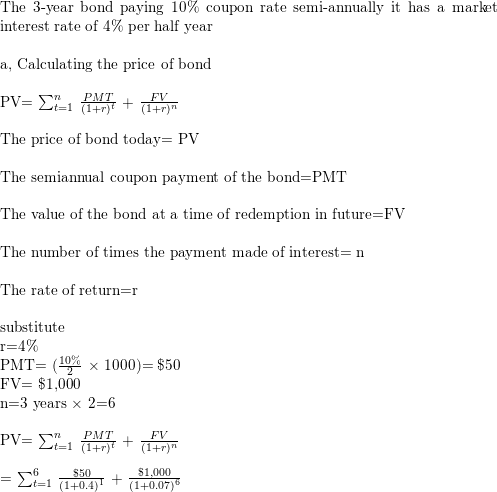

Consider a bond paying a coupon rate of 10 % per year semian

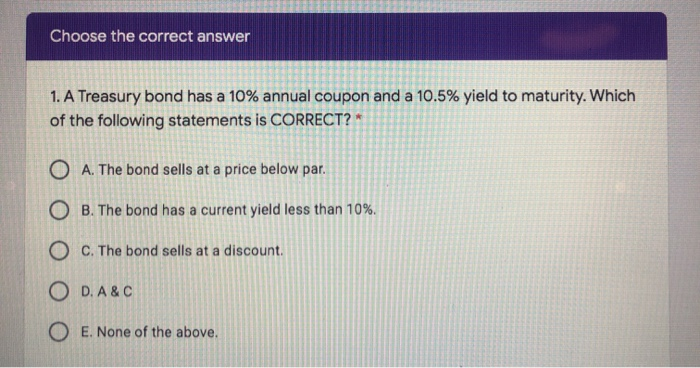

Solved Choose the correct answer 1. A Treasury bond has a

Bond J has a coupon rate of 4 percent and Bond K has a coupon rate of 10 percent. Both bonds have 12 years to maturity, make semiannual payments, and have a

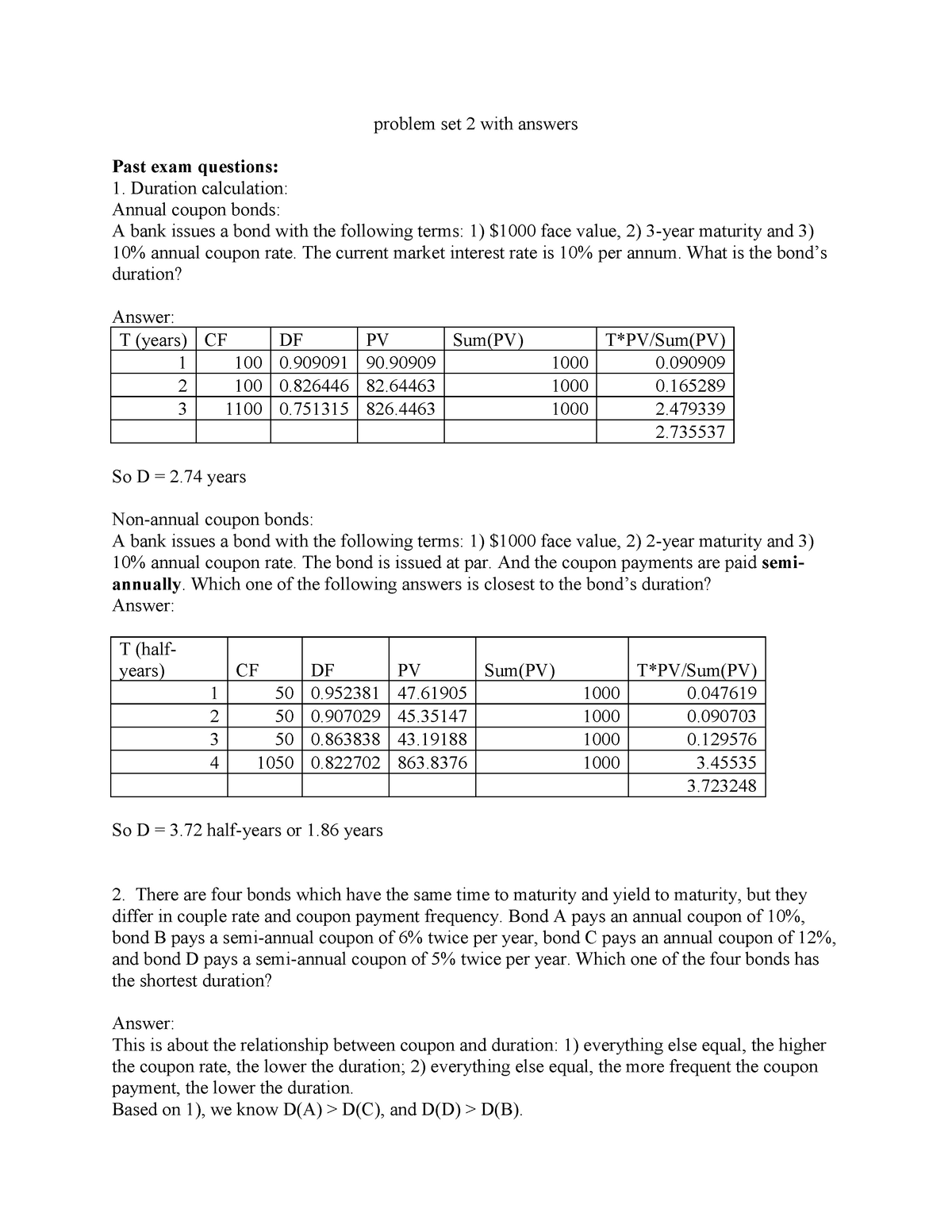

Problem set 2 with answers - problem set 2 with answers Past exam questions: 1. Duration - Studocu

A 10-year maturity bond with par value of $1,000 makes semiannual coupon payments at a coupon rate of 7%.

How to Calculate PV of a Different Bond Type With Excel

Lecture on bond - ppt download

Solved] . Bond #1 is a 10 year, 4.5% semiannual coupon bond. It has a

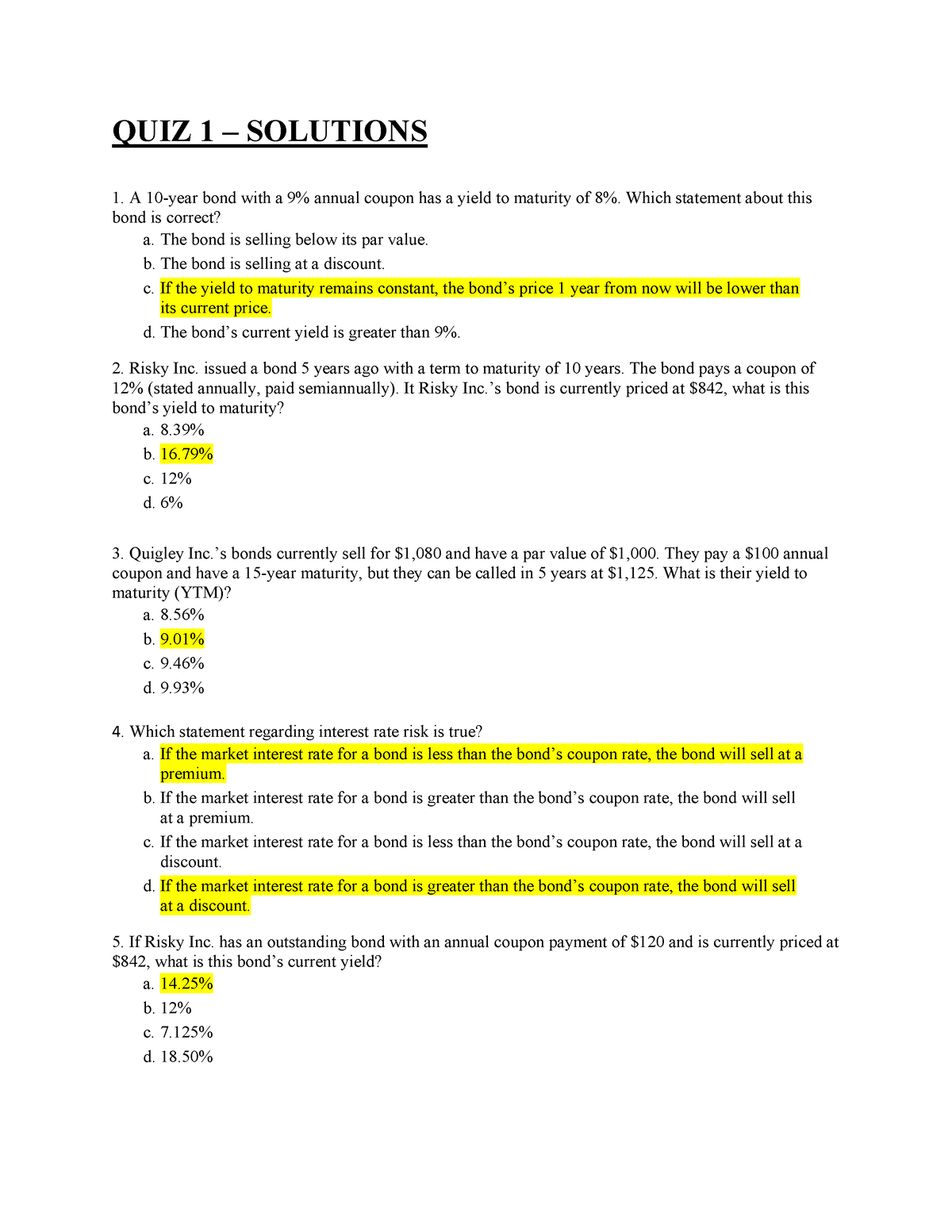

QUIZ 1 - Solutions iaf620 - QUIZ 1 – SOLUTIONS A 10-year bond with a 9% annual coupon has a yield to - Studocu