Death of Seamless Flow of ITC in 2022 – Major Changes under GST

$ 24.50 · 4.9 (678) · In stock

The wonder baby seamless flow of ITC which raised so many hopes and reduced the burdens, had been slowly placed into precarious health condition of late. On the Budget 2022 day it has been put on ventilator with no hope of recovery. The day when changes of Finance Act, 2022 are put into effect would be the date of death of seamless flow of ITC.

Not Maintaining Proper Documentation - FasterCapital

Articles

What to Do for Claiming GST ITC & Reversal for FY 22-23

Blog – Samuel J. Esaw

Patent 3204429 Summary - Canadian Patents Database

ITC Reversal under GST

Why Old Playbook of Growing D2C Channel is Dead in the New Normal

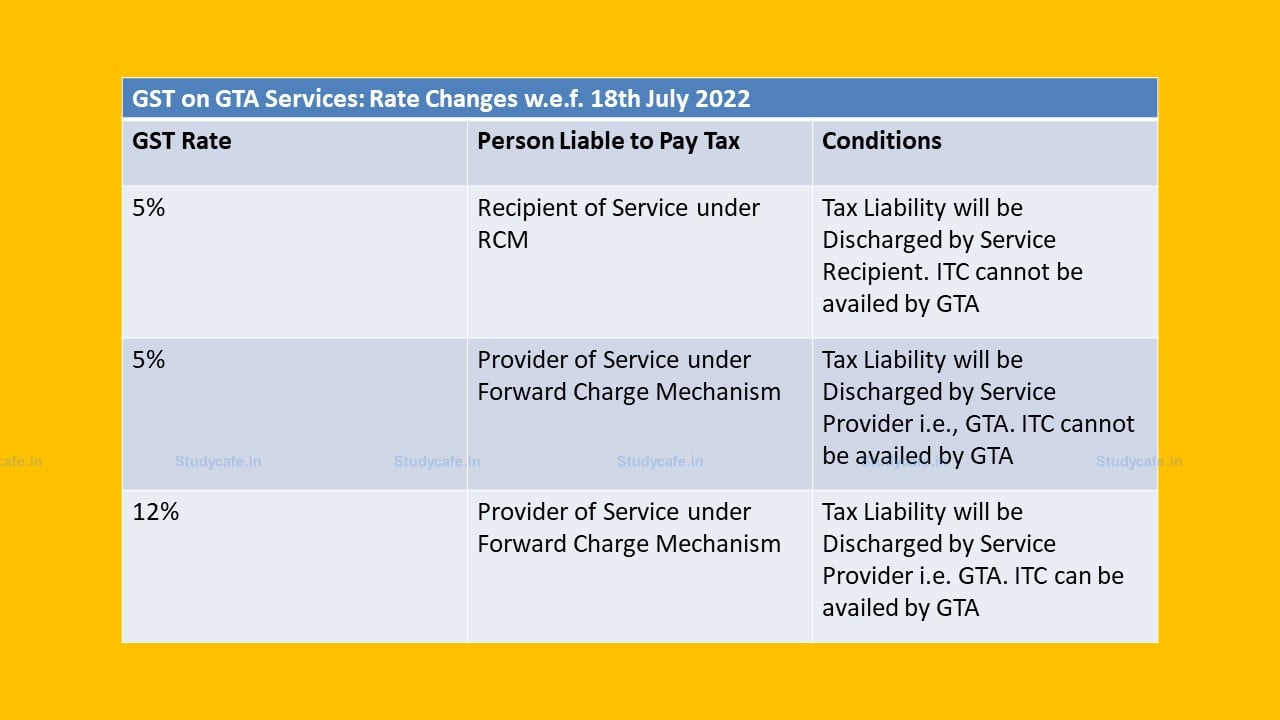

GST on Goods and Transport Agency Services: Know the New GST Rates

GST Concept Book (Amended), PDF, Taxes

GST may bring down construction cost: Will it cool down residential