How to calculate carry and roll-down (for a bond future's asset

$ 15.00 · 4.9 (735) · In stock

Fixed income: Carry roll down (FRM T4-31)

In calculating expected fixed income return, is expected currency

:max_bytes(150000):strip_icc()/convexity-4198782-a4e62f51917a4d07a4d03fe386e87c95.jpg)

Convexity in Bonds: Definition, Meaning, and Examples

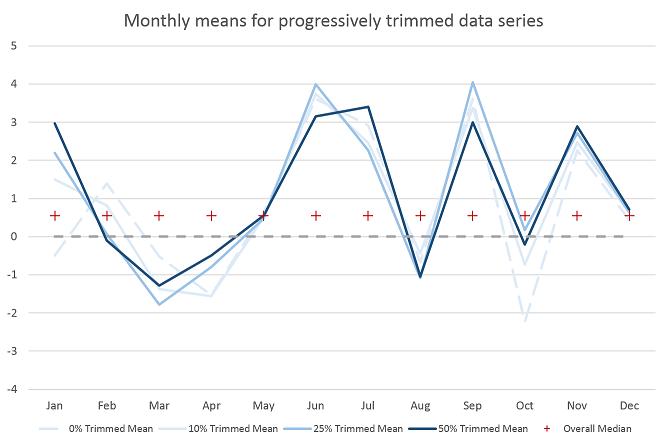

Riccardo Rossi on LinkedIn: Seasonality can be an input to trading decisions. In this post, I discuss…

:max_bytes(150000):strip_icc()/forwardrate.asp-final-abecab1927554cd58edbbe2e392e4b80.png)

Forward Rate: Definition, Uses, and Calculations

fixed income - Carry calculation on an interest rate swap

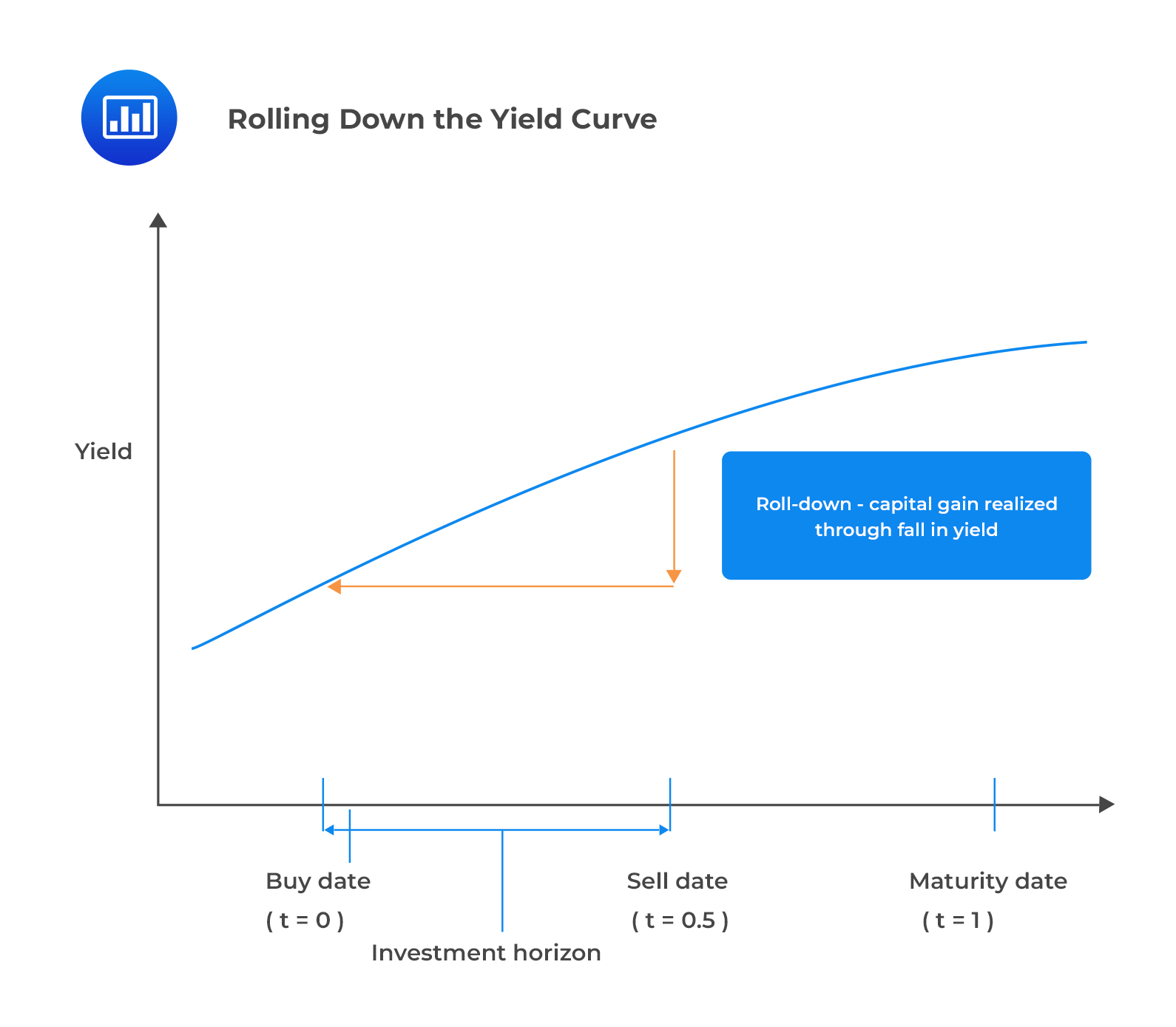

Riding the Yield Curve - CFA, FRM, and Actuarial Exams Study Notes

Carry and Roll-Down of USD Interest Rate Swaps in Excel with

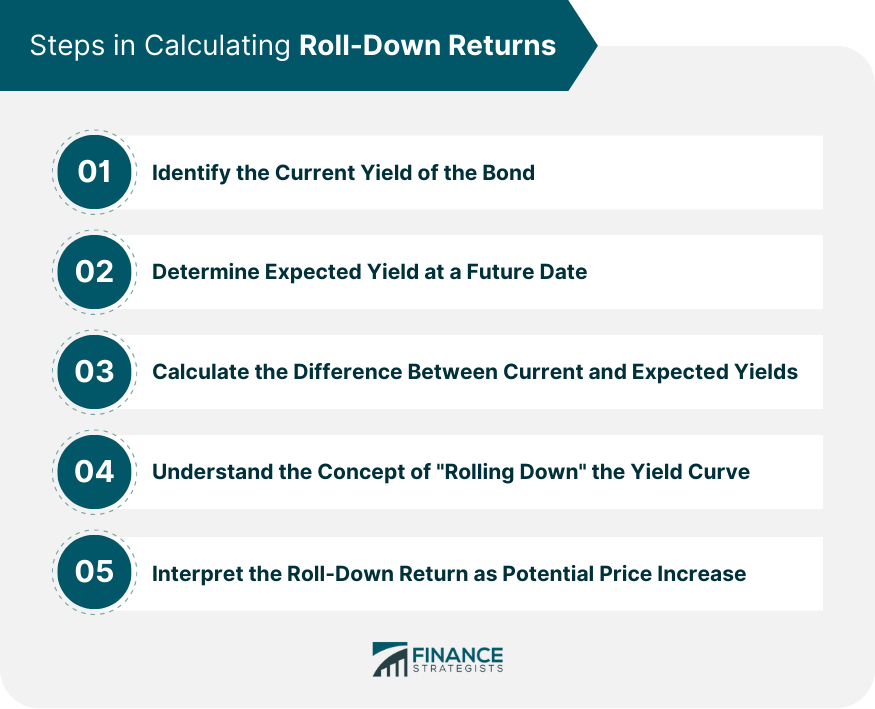

Roll-Down Return Definition, Elements, Calculation, Applications

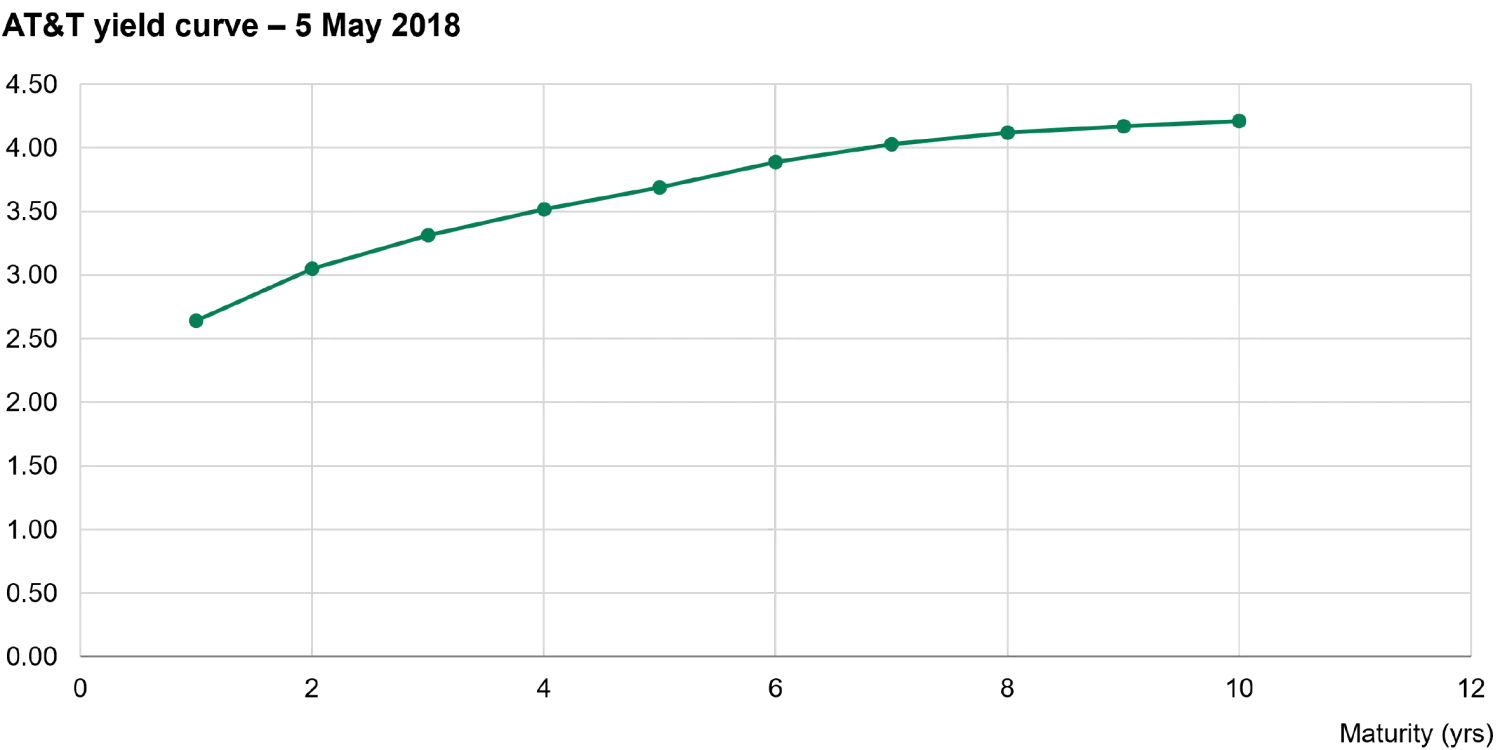

Riding the yield curve – BSIC Bocconi Students Investment Club

Fixed Income 101: Roll-down

Keep Calm and “Carry and Roll” On

Carry and Roll-Down of USD Interest Rate Swaps in Excel with