The Venture Capital Risk and Return Matrix - Industry Ventures

$ 8.50 · 4.6 (68) · In stock

Generally speaking, we found that the likelihood of achieving expected returns is not simply a function of high multiples. In fact, it varies depending on risk profile. For direct investments, loss rates and holding periods play a significant role. For venture fund counterparts, the same holds true, but exit strategies – whether through IPO or M&A – and capital-deployment timing also matter a great deal.

Risks and rewards of venture capital - FasterCapital

Public To Private Equity in The United States: A Long-Term Look, PDF, Leveraged Buyout

Setting Up A Risk Management Plan - FasterCapital

Early-stage valuations are down 20-30%. They should ideally fall

Top 10 Venture Capital Firms in India

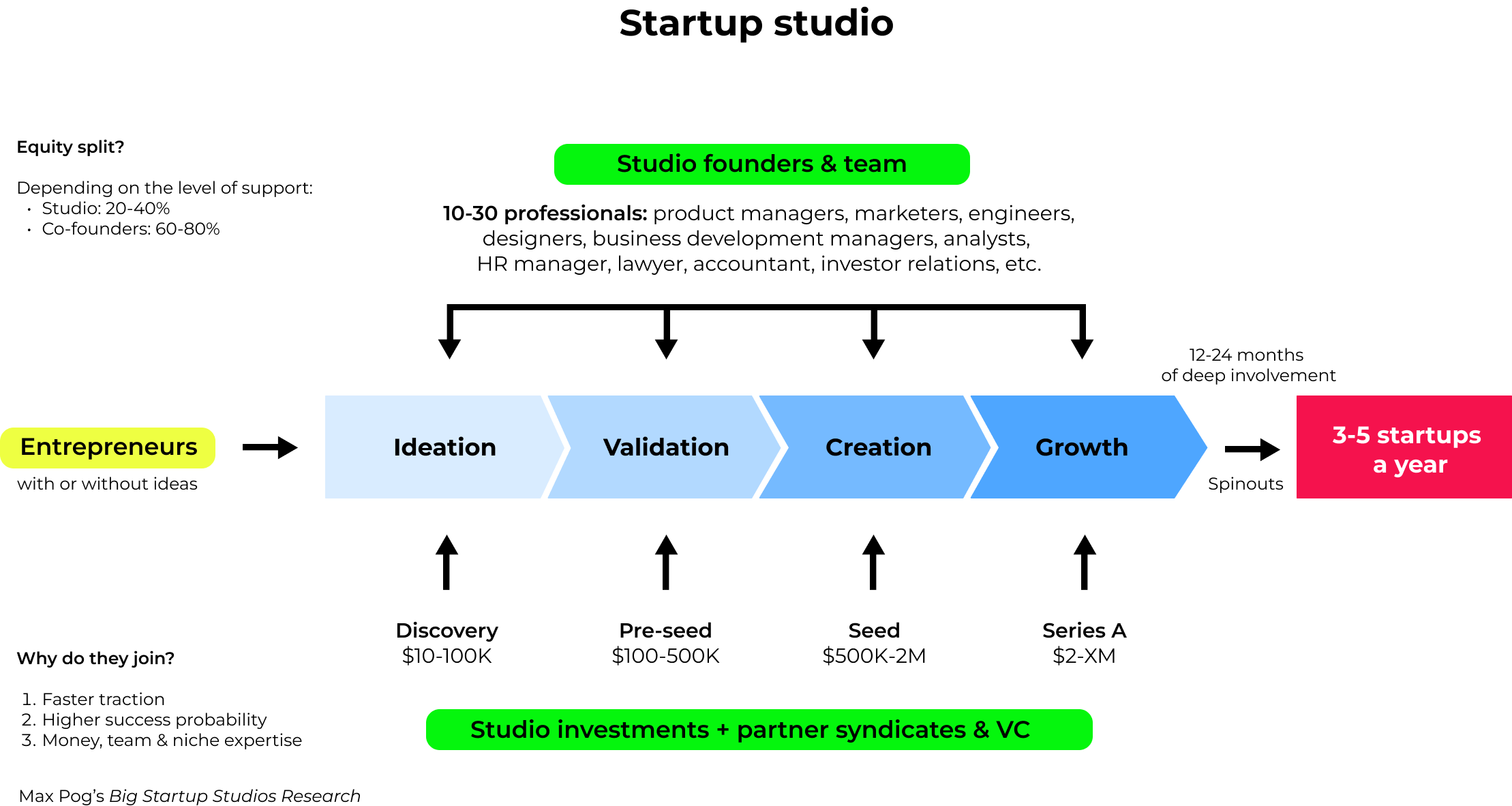

Big Startup Studios Research 2023

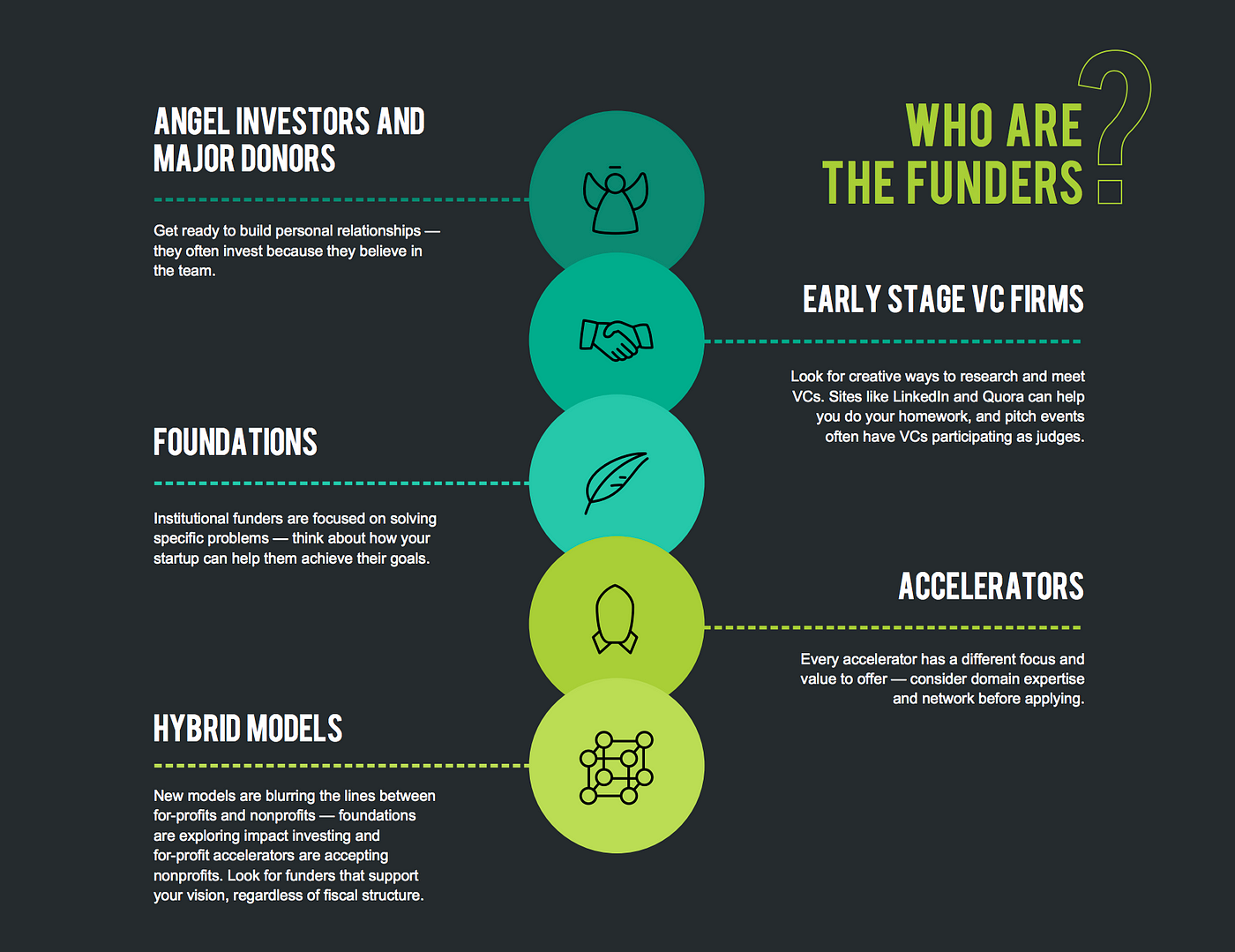

From Angel Investors to Accelerators: Funding to Scale your

How to Manage a VC Fund Unique.vc Learning Center

风险投资是一种什么样的投资方式? - 知乎