What is the journal entry to record a foreign exchange transaction gain? - Universal CPA Review

$ 8.99 · 4.6 (91) · In stock

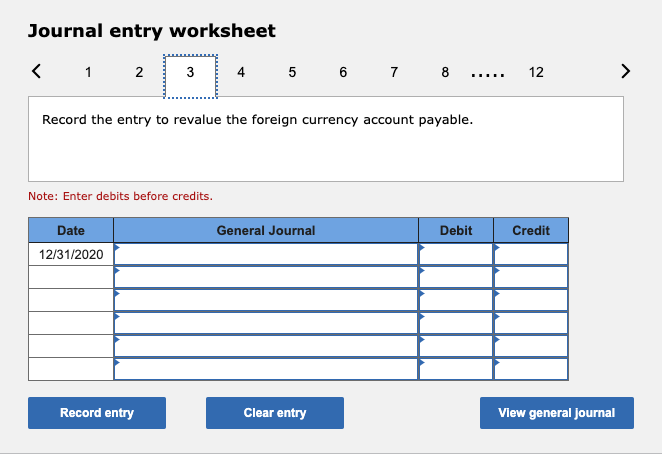

A foreign exchange transaction gain occurs when the transaction currency is different than the reporting currency for the company. On the initial transaction date, they would record the $100 sale with a debit to accounts receivable and a credit to revenue. However, 30 days later when the customer goes to pay using the current exchange

Integrated Cyber Commences Trading on the Frankfurt Stock Exchange

What is the journal entry to record an unrealized gain on an

Currency Exchange Gain/Losses

Accounting For Cryptocurrencies: All You Wanted to Know Know About

Oracle Payables User's Guide

Solved Journal entry worksheet Record the foreign exchange

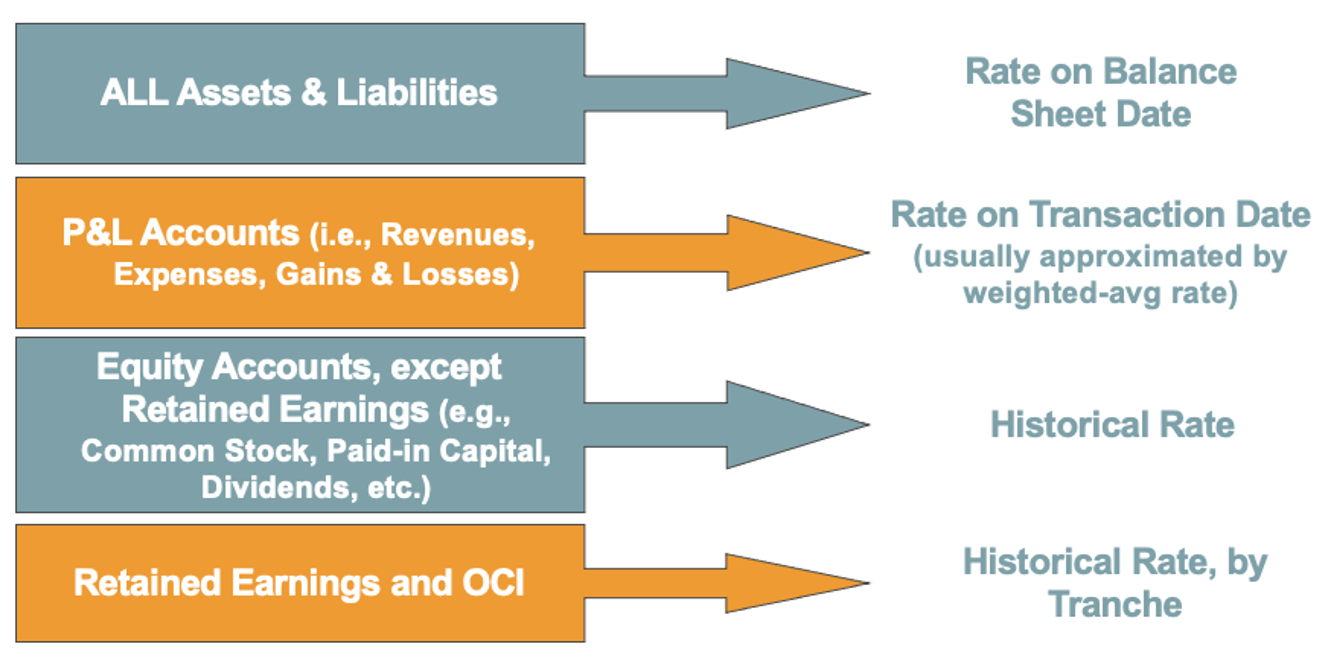

Foreign Currency Matters

Property Management Accounting Basics: Definitive Guide

18 Advanced Accounting: Foreign Currency Transactions (Part 1

Work with Journal Entries with Foreign Currency

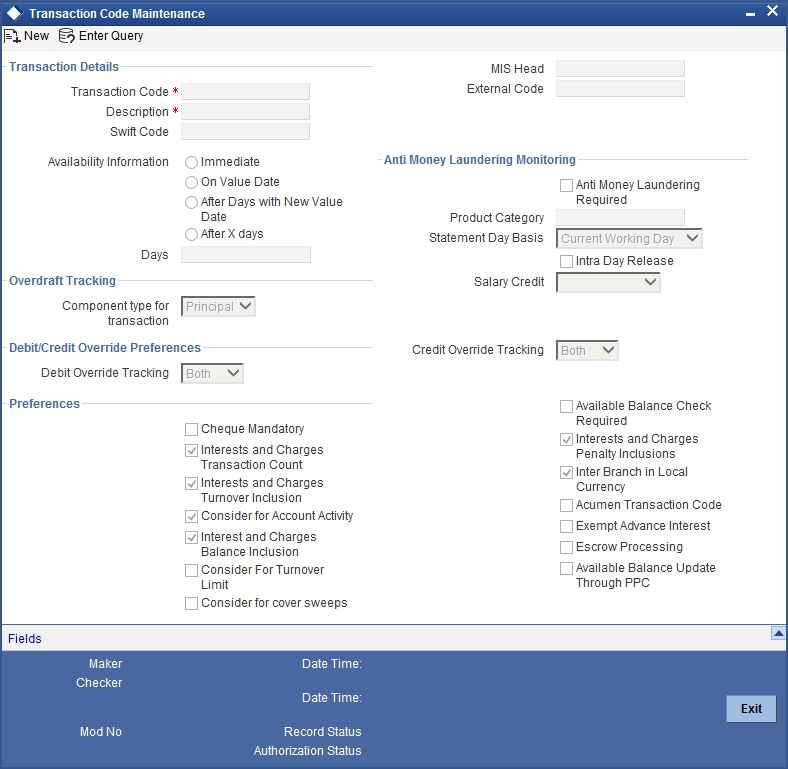

21. Transaction Code

Ethics in Accounting Definition, Importance & Examples - Lesson

Document

Foreign Currency Transaction w/ Journal Entries (FAR MCQ