Tax Credits for Individuals and Families

$ 21.99 · 4.9 (664) · In stock

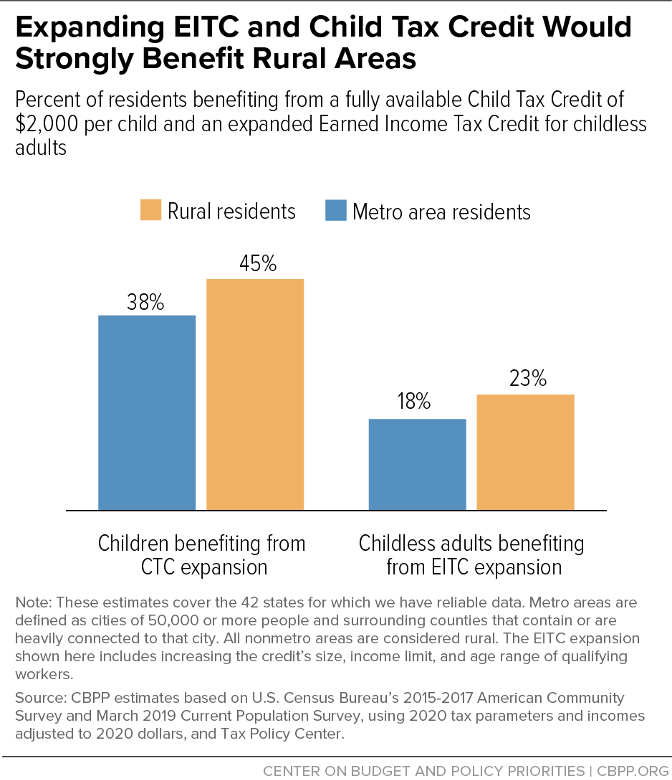

The Earned Income Tax Credit (EITC) encourages and rewards work for low- and moderate-income working people, while the Child Tax Credit helps families offset the cost of raising children.Together, the EITC and the low-income piece of the Child Tax Credit benefit 30 million households with low incomes, lifting 10 million people above the poverty line. We work to highlight the benefits of these credits and to protect and expand them to further reduce poverty.

Best Income Tax Saving Investment Options in India

Eligibility for Tax Deduction under Section 80DDB: Understanding

Tax Credits for Individuals and Families

Personal income tax credits - FasterCapital

Expanding Child Tax Credit and Earned Income Tax Credit Would

The speech from the throne

The Take Responsibility for Workers and Families Act: Division T

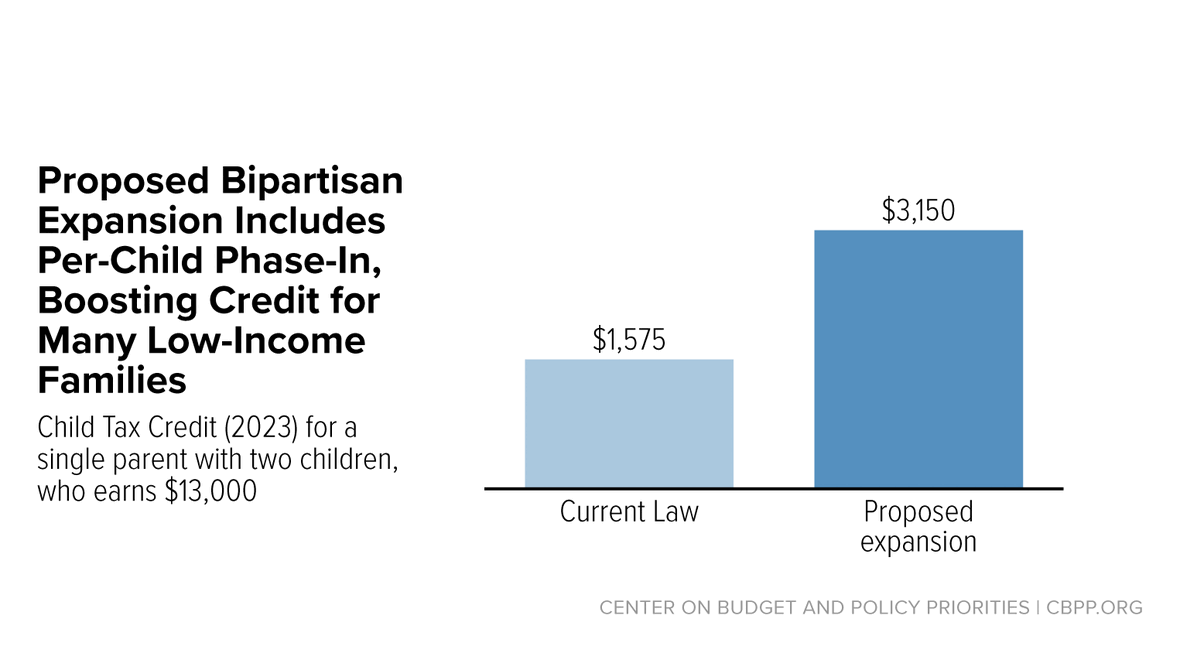

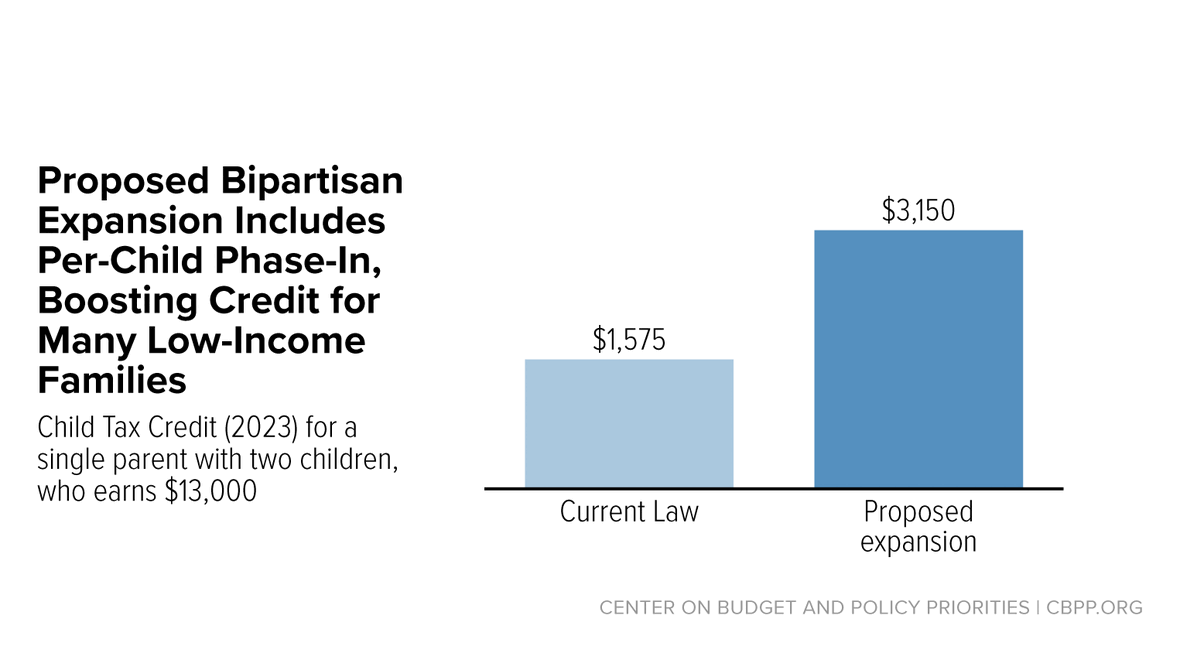

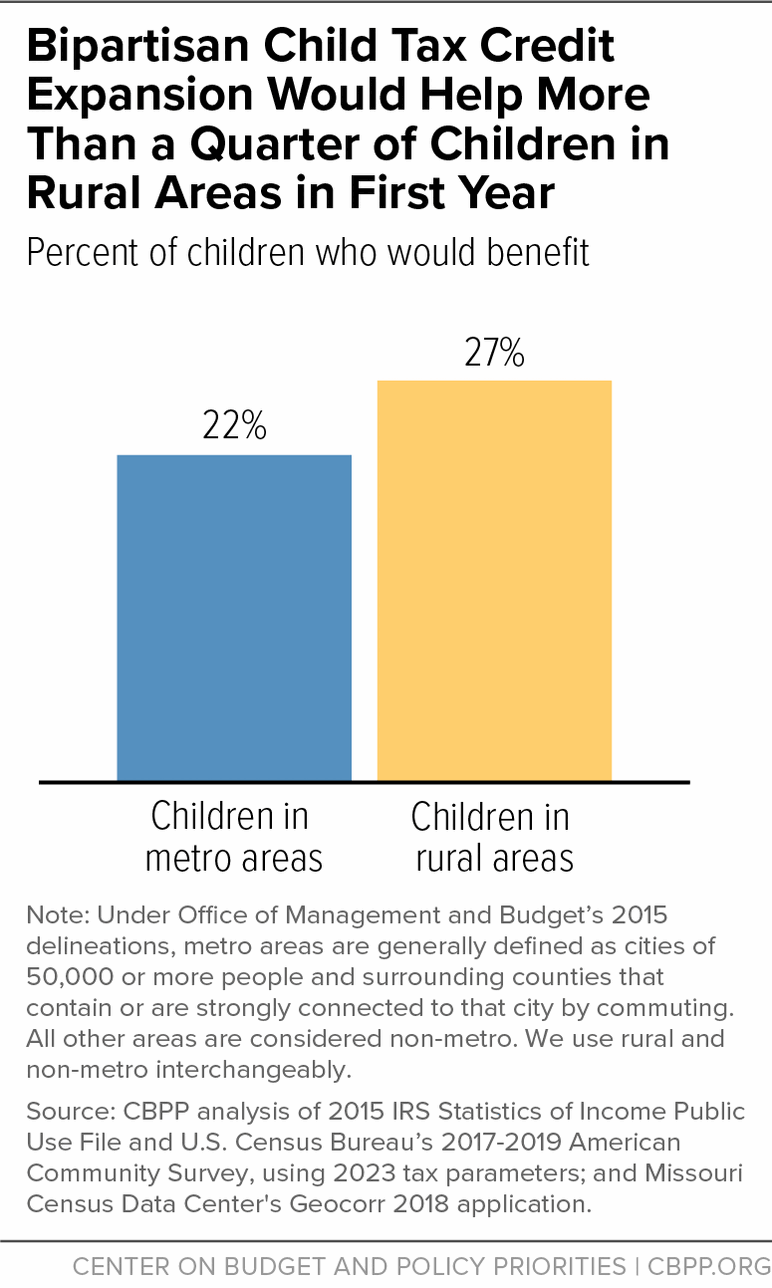

House-Passed Bipartisan Tax Bill's Child Tax Credit Expansion

.jpg)

Health Insurance Webster Chamber of Commerce

Federal Tax Credit - FasterCapital

Can Couples Split Health Insurance Premium for Tax Benefit?