Calendar Spreads in Futures and Options Trading Explained

$ 16.00 · 4.5 (617) · In stock

:max_bytes(150000):strip_icc()/calendarspread.asp_final-6628bf3928bd4717bde925a70b28ac8c.png)

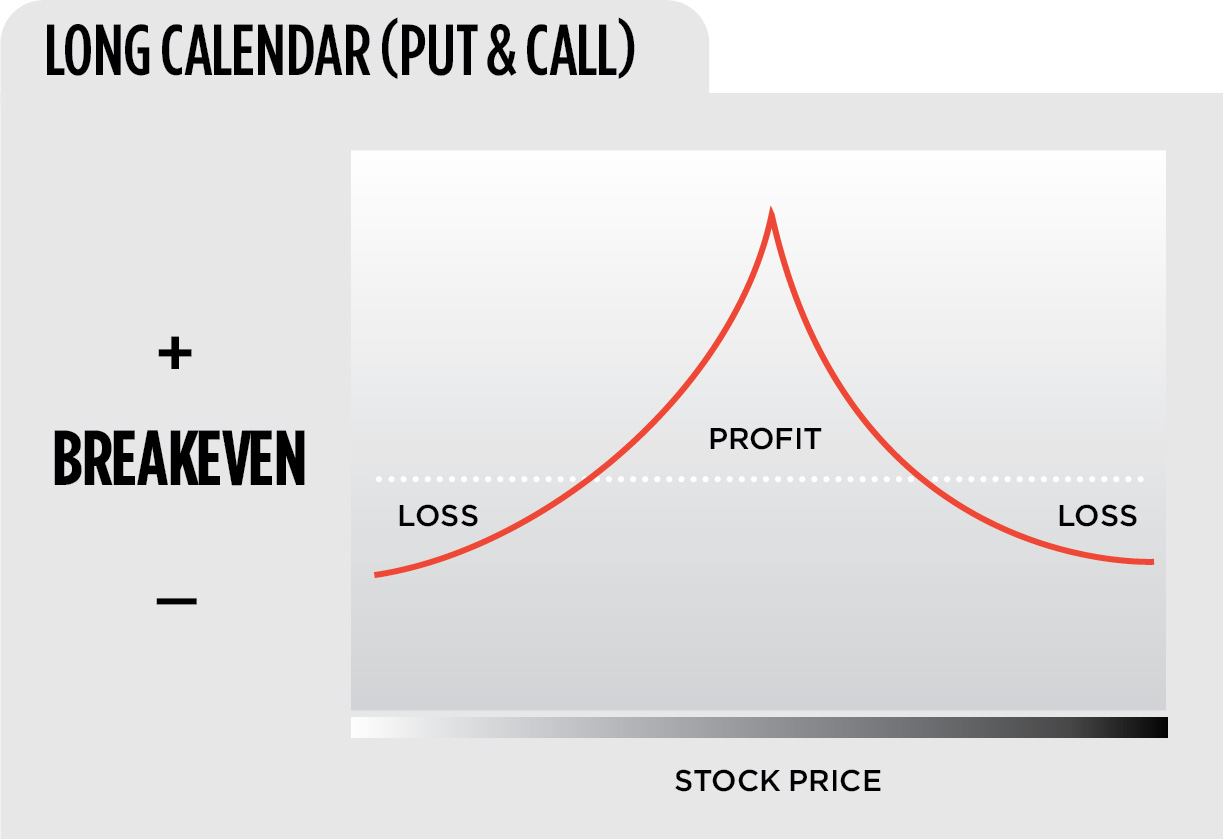

A calendar spread is a lower-risk options strategy that profits from the passage of time or an increase in implied volatility.

It's About Time: Range-Trading with the Calendar Spread - Ticker Tape

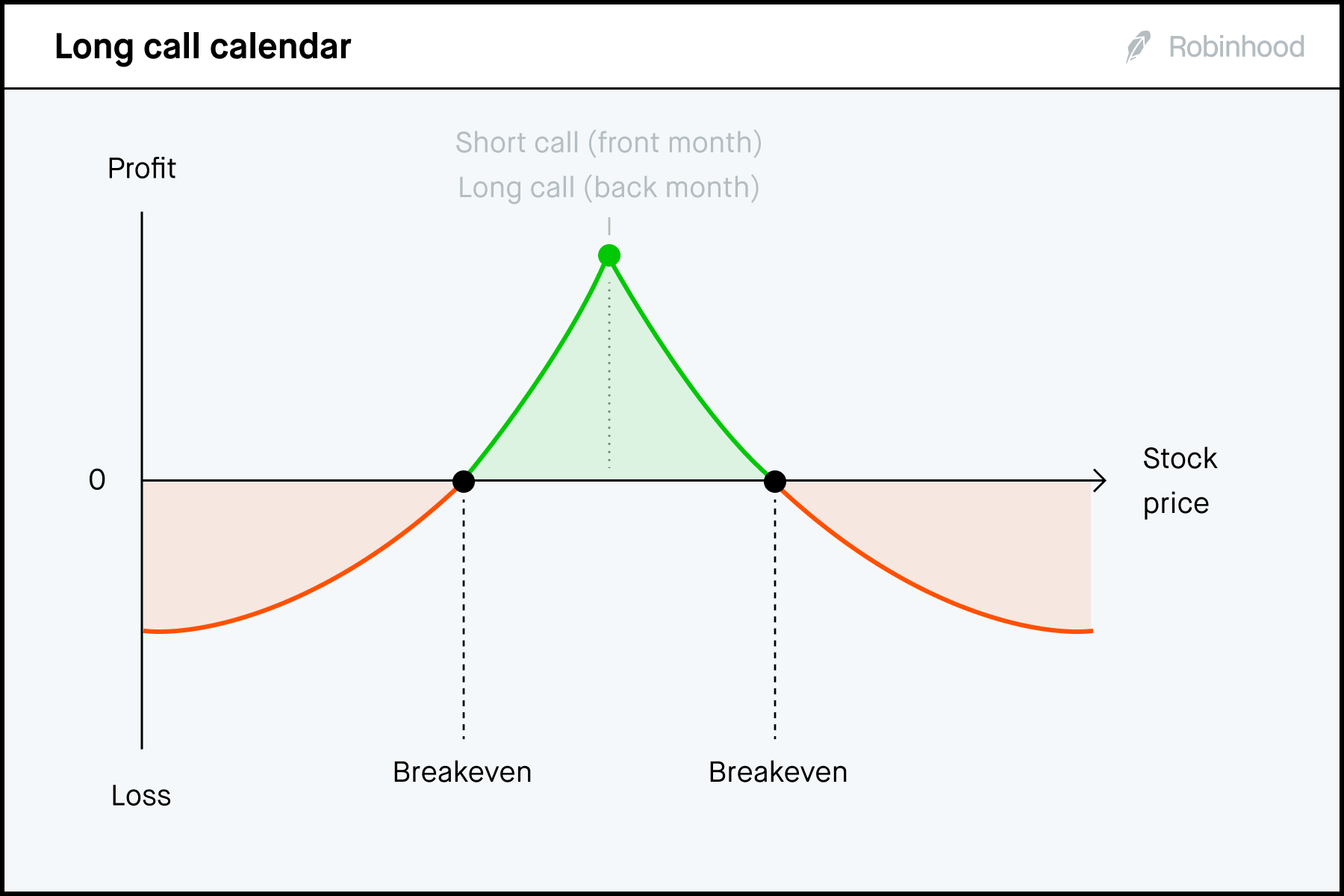

Calendar Call: Definition, Purpose, Advantages, and Disadvantages

:max_bytes(150000):strip_icc()/rateofchange.asp-final-f20db45c203b4651b8bdcd6d34b3d6d1.png)

James Chen

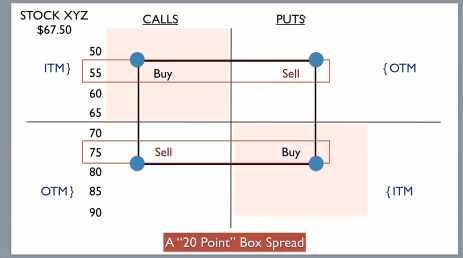

Box spreads Illustrated and Explained

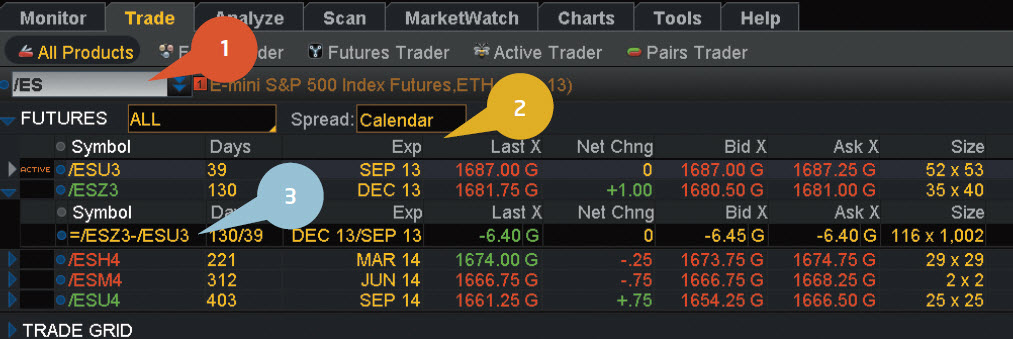

Sizing Up (and Breaking Down) a Futures Calendar Spread - Ticker Tape

:max_bytes(150000):strip_icc()/DemystifyingA.I.andHowtoHarnessittoLearnandEarnMore-39debeec8cea452596ad35f02d899d97.jpg)

The Future of Financial Planning

:max_bytes(150000):strip_icc()/TheLegendofJackBogleandtheFutureofETFs-31cda6dbba0643139ade64302522084e.jpg)

The Future of Financial Planning

Calendar Spread - Definition, Option Strategy, Types, Examples

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

:max_bytes(150000):strip_icc()/GettyImages-1007257652-5bec683746e0fb00518e34f7.jpg)

Futures vs. Options: What's the Difference?

Calendar Spread Options Trading Strategy In Python

Advanced options strategies (Level 3)

![]()

Tamil Language Wikipedia, 56% OFF

Tamil Language Wikipedia, 56% OFF

Spread