Options Vega - The Greeks - CME Group

$ 5.50 · 5 (620) · In stock

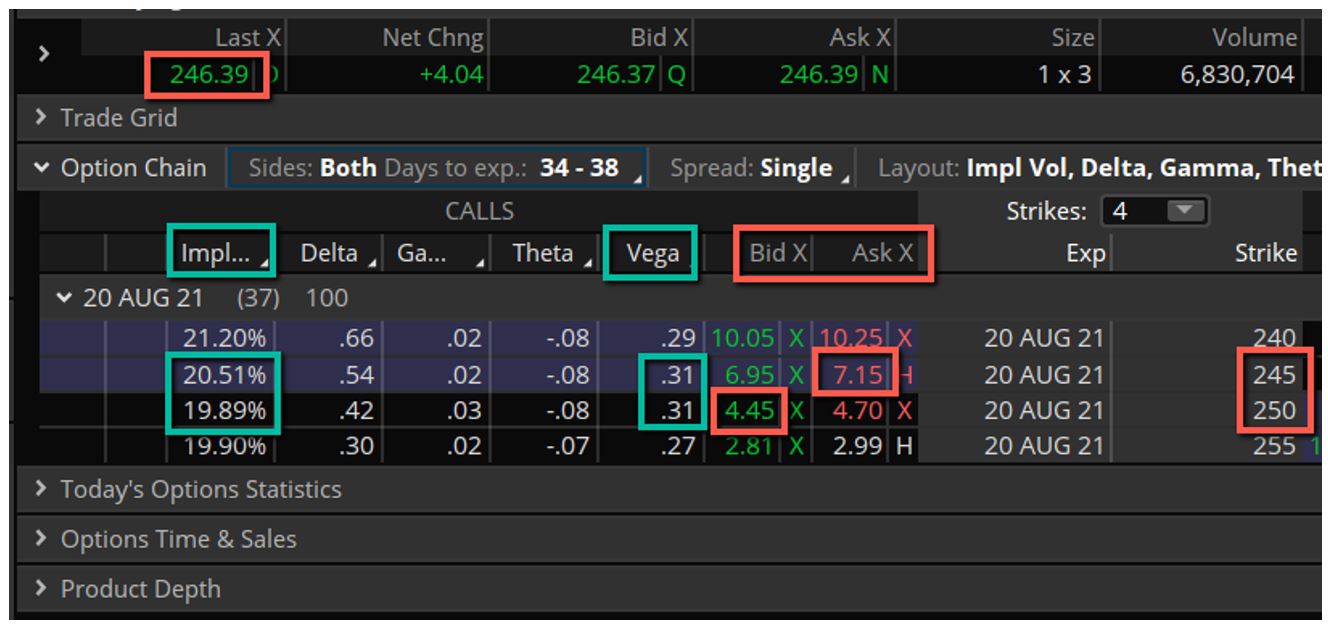

Learn about the Greek letter Vega, which measures an option’s sensitivity to implied volatility, and its role in options strategies.

Trading Options Greeks: How Time, Volatility, and Other Pricing Factors Drive Profits (Bloomberg Financial Book 159) eBook : Passarelli, Dan, Brodsky, William J.: : Kindle Store

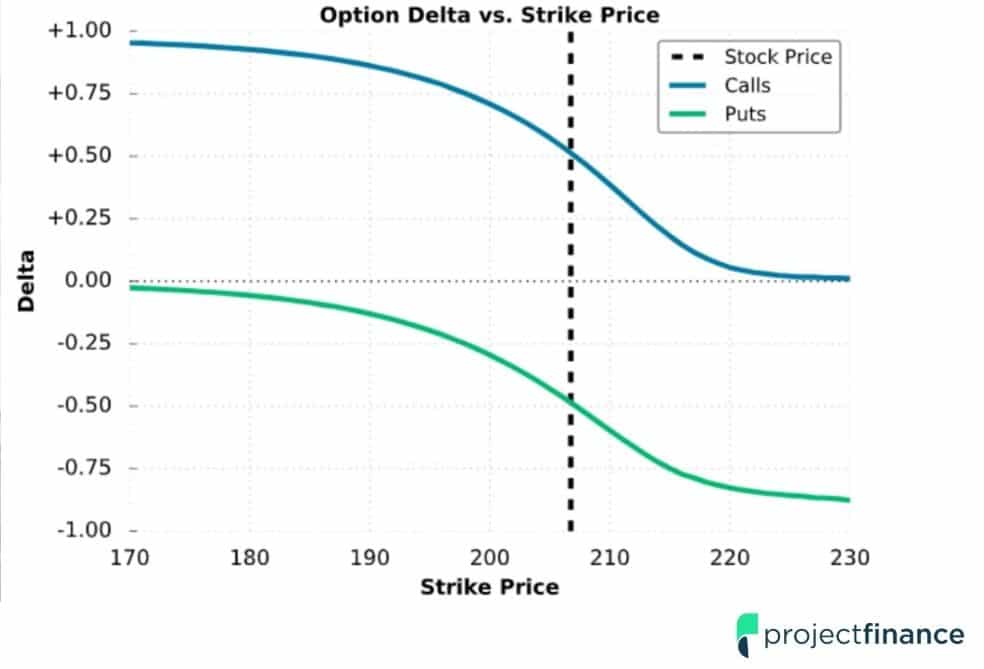

The Greeks for Beginners: Delta, Gamma, Theta & Vega - projectfinance

Trading Options Greeks - Investment / Trading - Finance

The Greeks for Beginners: Delta, Gamma, Theta & Vega - projectfinance

Option Vega - How It's Different From Other Option Greeks - Market Taker

Option Greeks and Implied Volatility for FX_IDC:XAUUSD by financialflagship — TradingView

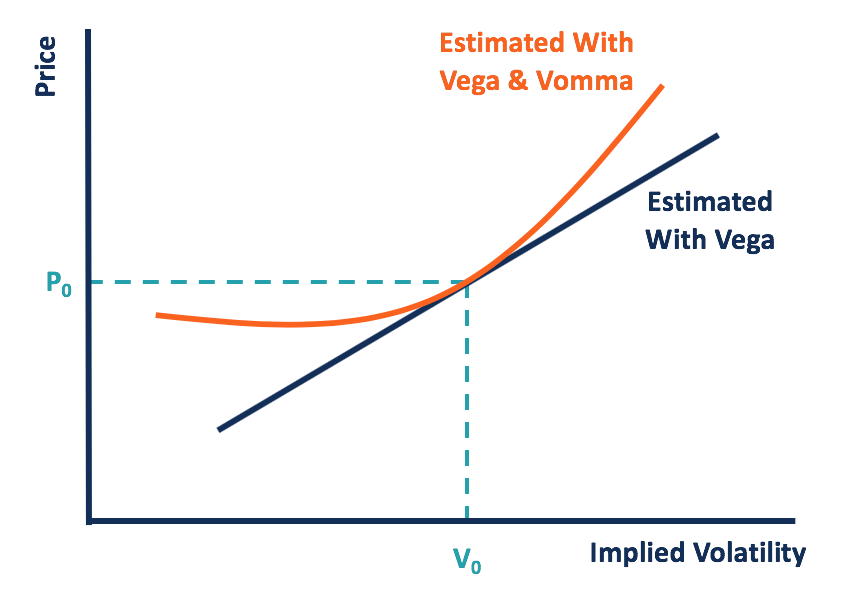

Vomma - Overview, Characteristics, Vega, Ultima, and Formula

Option greeks: Mastering Vega Neutral Strategies and Option Greeks - FasterCapital

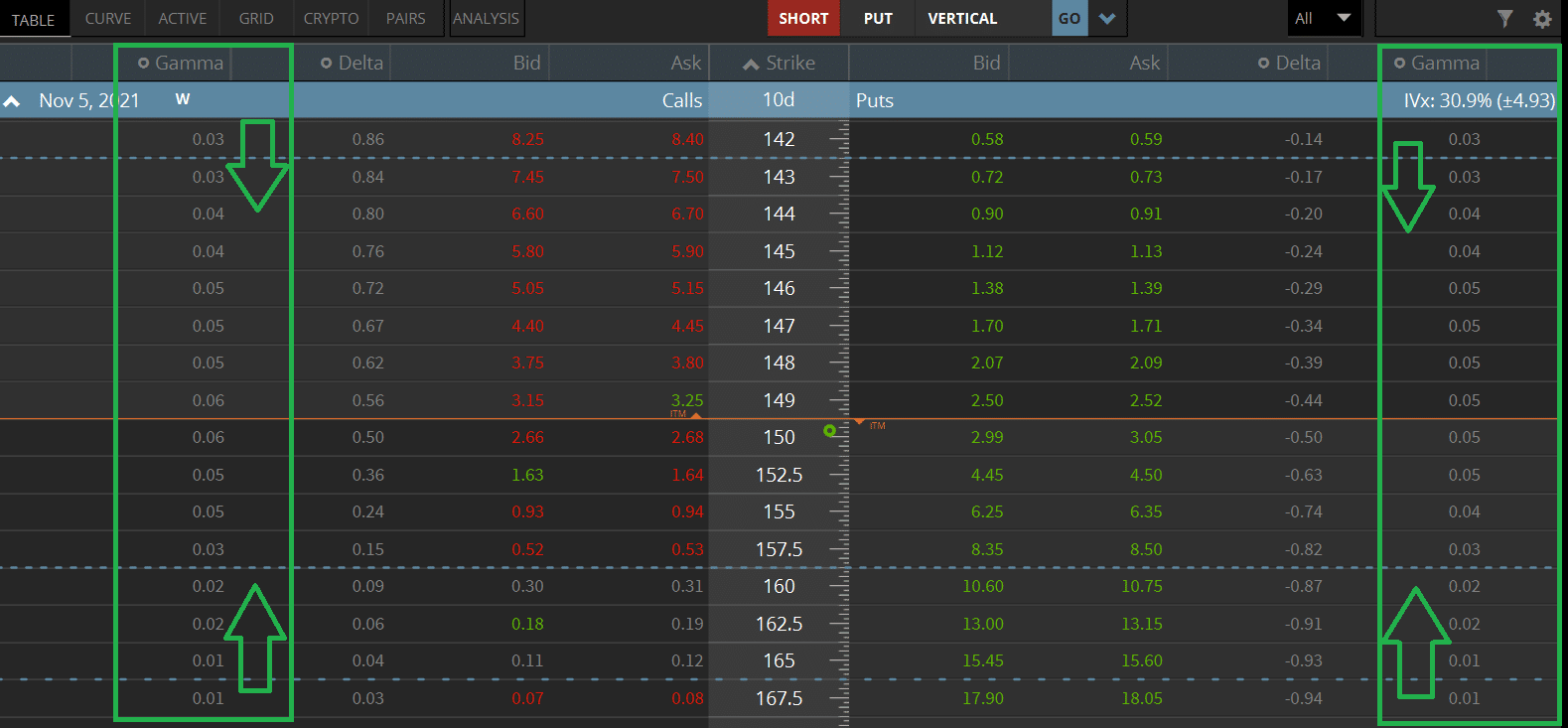

The Greeks for Beginners: Delta, Gamma, Theta & Vega - projectfinance

Trading Options Greeks: How Time, Volatility, and Other Pricing Factors Drive Profits: 159 (Bloomberg Financial): : Passarelli, Dan, Brodsky, William J.: 9781118133163: Books

:max_bytes(150000):strip_icc()/dotdash_Final_Using_the_Greeks_to_Understand_Options_Aug_2020-01-5905879905614e4e979e60e572c8e3a4.jpg)

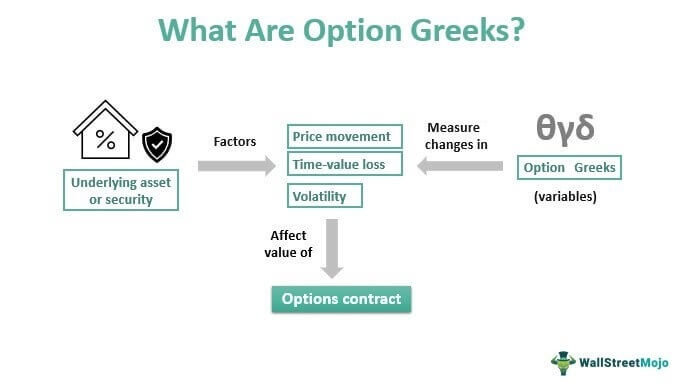

Using the Greeks to Understand Options

Vega: Unlocking the Power of Vega in Credit Spread Options - FasterCapital

Options trading part 5: Vega/Volatility risk

Option Greeks Meaning, Uses