CRA Travel Expenses For Employees - Travel Expenses Rules For 2024

$ 17.00 · 5 (733) · In stock

Need to know how to receive travelling expenses reimbursement from your employer? Learn about CRA travel expenses and if they are taxable as part of your income.

CRA Travel Expenses For Employees - Travel Expenses Rules For 2024

Employees working from home by choice can claim expenses, CRA says

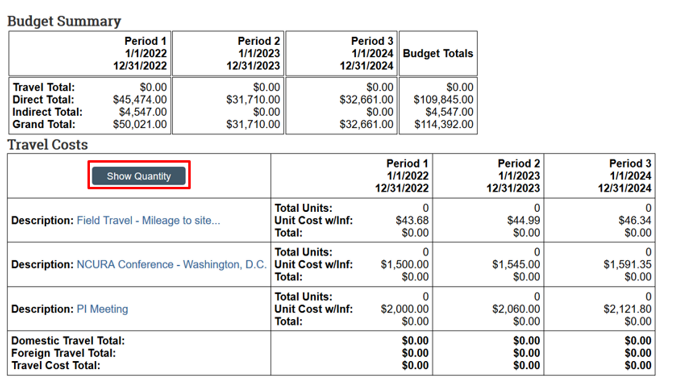

2.1.6 Travel Costs - SmartForm

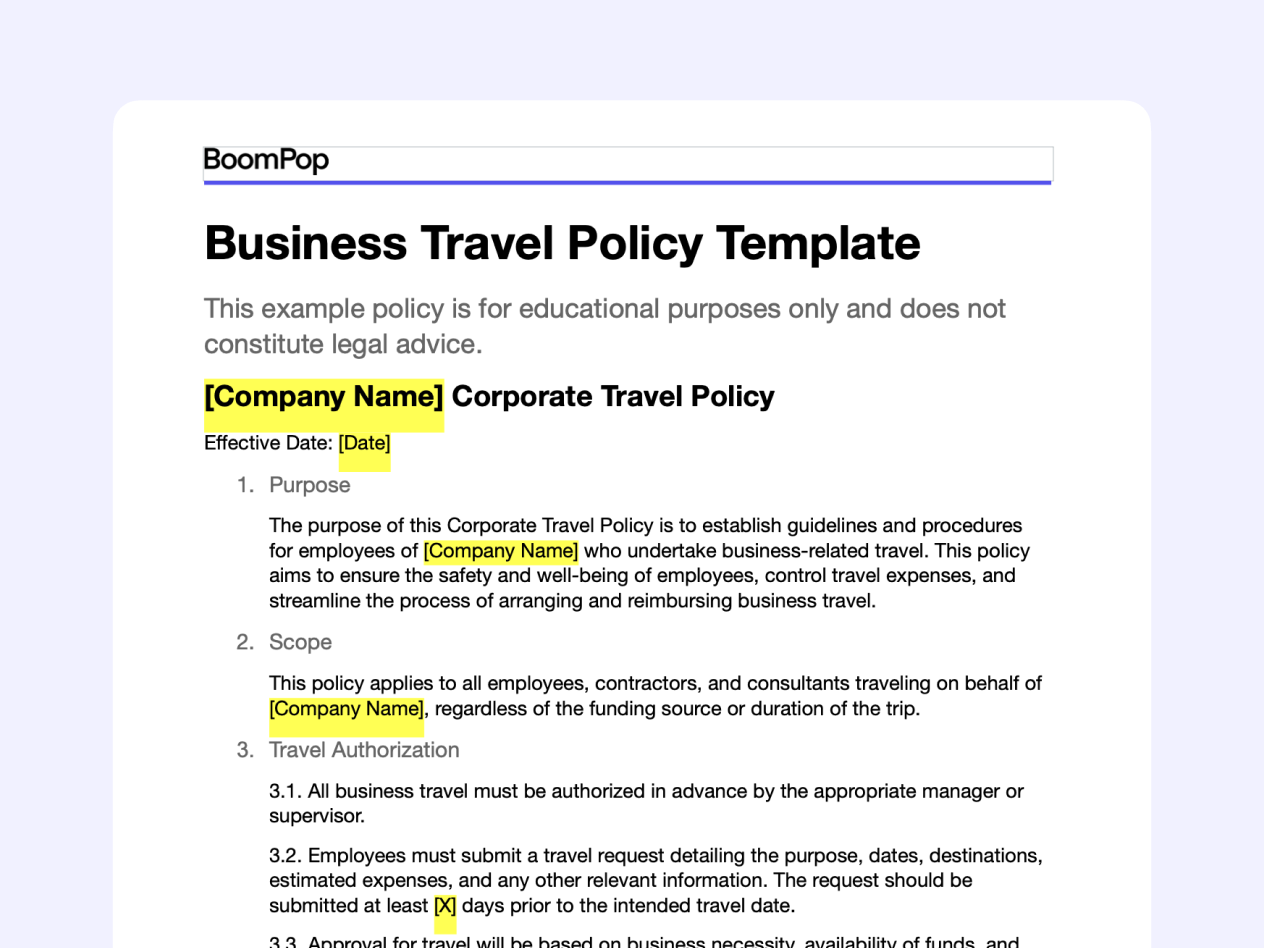

Template: Corporate Travel Policy

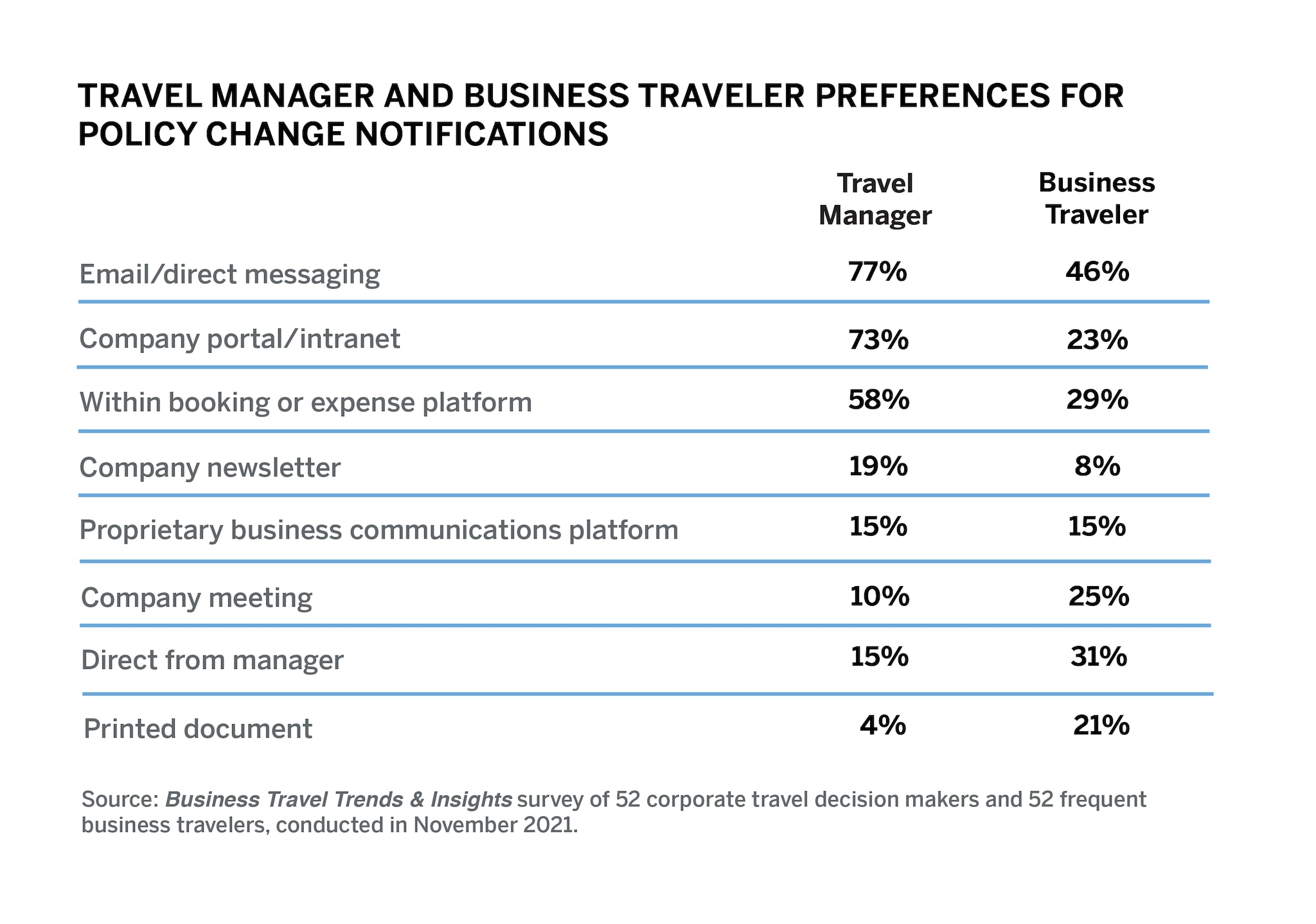

Five Ways to Ensure an Understanding of Travel and Expense Policies

Home Office Expenses - How to use the CRA Calculator? & How to use UFile to prepare your tax return?

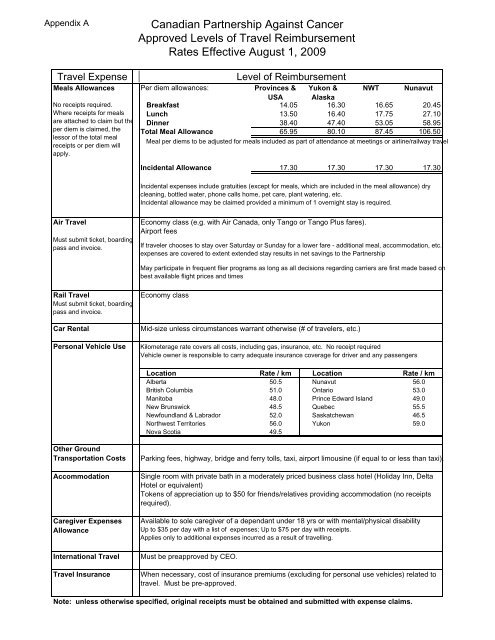

Per Diem Allowances for Business Travel

Travel Expense Claim Forms.pdf

Travel Expense Form - 15+ Examples, Format, PDF

Government Employee? NPS Tier II tax saver scheme guidelines released - Income Tax News

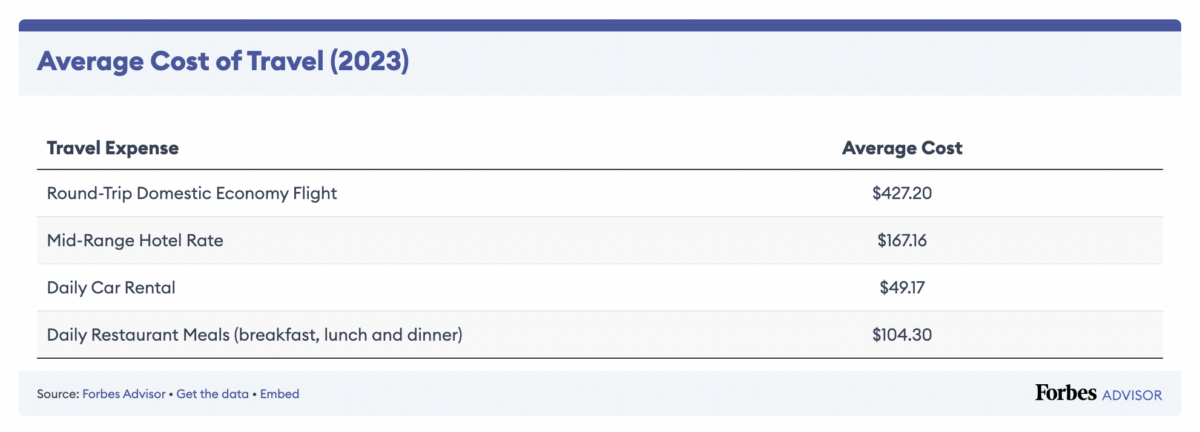

How Much Should a Business Trip Cost? - TravelBank

Calculating Travel Expenses for Businesses, 11 Best practices