Tax Brackets in the US: Examples, Pros, and Cons

$ 11.00 · 5 (313) · In stock

:max_bytes(150000):strip_icc()/Tax_Bracket-Final-1824baf32c144f4db2f9ca7c7e8a5faa.jpg)

A tax bracket is a range of incomes subject to a certain income tax rate.

Difference between Direct and Indirect Tax: Advantages & Disadvantages

Examples of studies examining carbon tax revenue recycling

Tax And Investment Tips To Consider As 2020 Comes To A, 59% OFF

:max_bytes(150000):strip_icc()/standarddeduction-resized-8f2ac3f88bca4ef099d637cb80f79e29.jpg)

Taxable Income: What It Is, What Counts, and How To Calculate

Tax Structure Definition & Types - Lesson

4 Types of Business Structures — and Their Tax Implications

Marginal Tax Rates in The United States

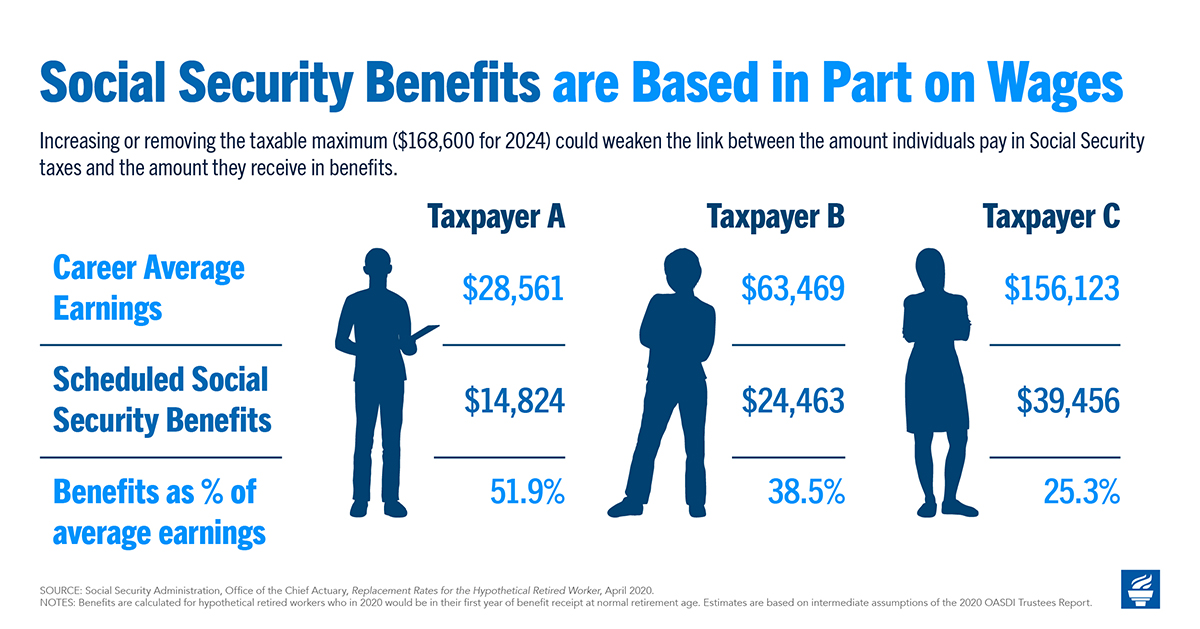

Should We Eliminate the Social Security Tax Cap? Here Are the Pros

:max_bytes(150000):strip_icc()/Incometaxes-9dacb2fc1d314896821b07f3933f0c4e.png)

Taxes Definition: Types, Who Pays, and Why