Australian Government Bonds - Bond Adviser

$ 24.99 · 4.5 (270) · In stock

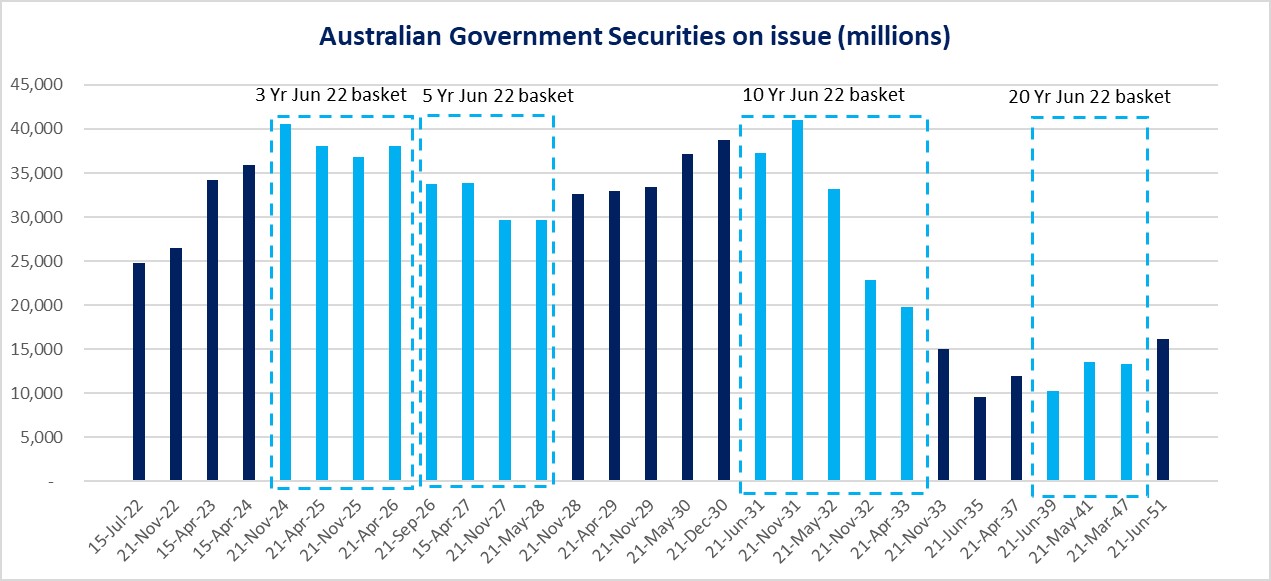

Commonwealth Government Bonds (CGS) are medium to long term debt issued by the Treasury through the Australian Office of Financial Management (AOFM). These securities pay a fixed coupon semi-annual in arrears, which are redeemable at face value on the specified maturity date and are the most liquid fixed income security in the Australian. Bonds issued

What's unique about Australian bond futures?

What's happened to the 10-Year Government Bond Yield? - Bond Adviser

Understanding Fixed Income & Bonds

Australia Government Bonds - Yields Curve

Semi Government Bonds - Bond Adviser

Australian Bonds Climate Class Action Can Proceed

Bonds and the Yield Curve, Explainer, Education

Understanding Fixed Income & Bonds

Solved] The links in the question are as follow

Value of a Financial Advisor

:max_bytes(150000):strip_icc()/WherecanIbuygovernmentbonds1_2-8e2ac360d217459eb54ebea0070eb5b5.png)

Where Can I Buy Government Bonds?

:max_bytes(150000):strip_icc()/dotdash-INV-final-Bond-Spreads-A-Leading-Indicator-For-Forex-Apr-2021-01-5f06416c041d49c083116bd4d3d61cf2.jpg)

Bond Spreads: A Leading Indicator For Forex

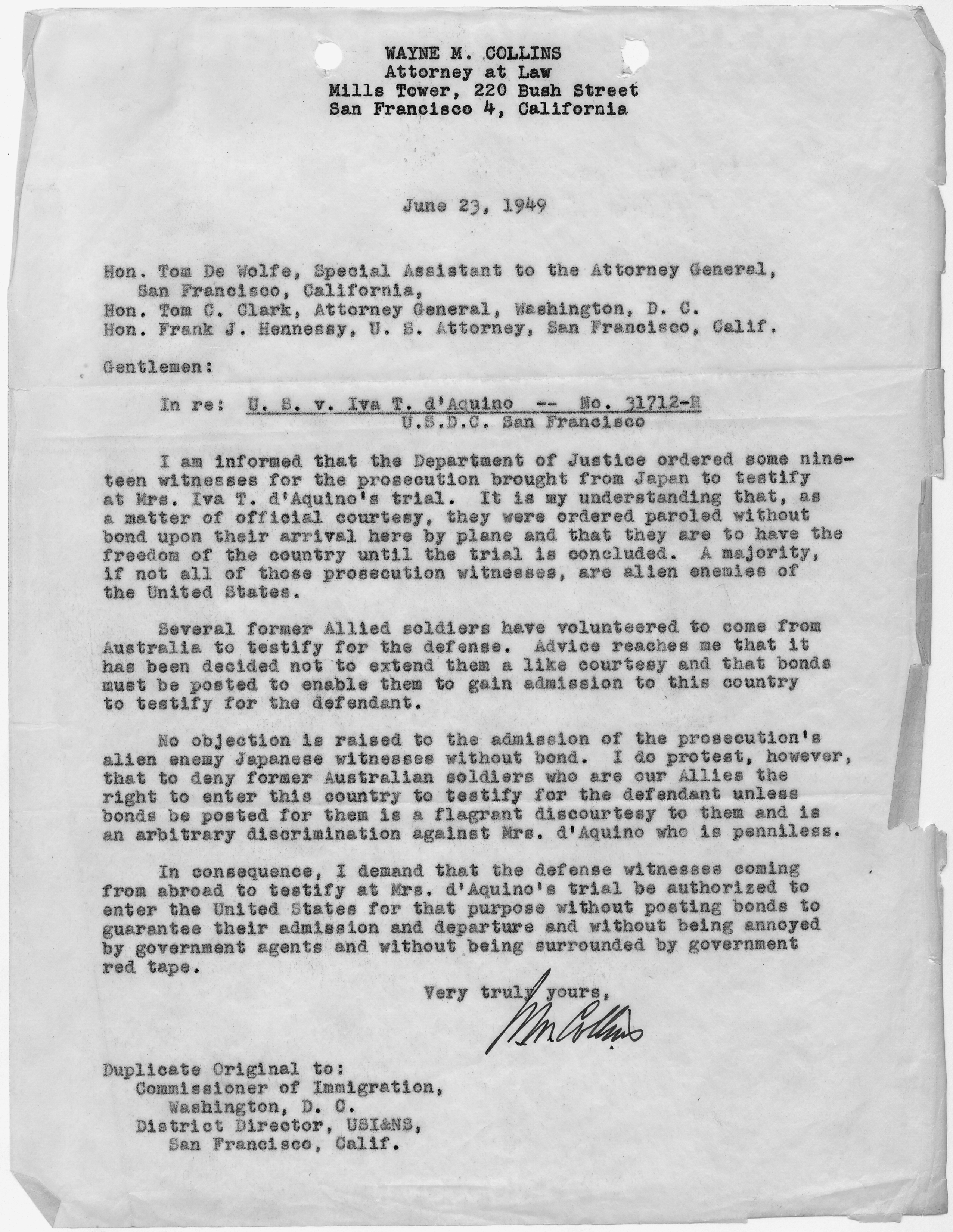

File:Letter from Wayne Collins, attorney for the defense, to Tom DeWolfe, Special Assistant to the Attorney General, et al. - NARA - 296670.jpg - Wikipedia

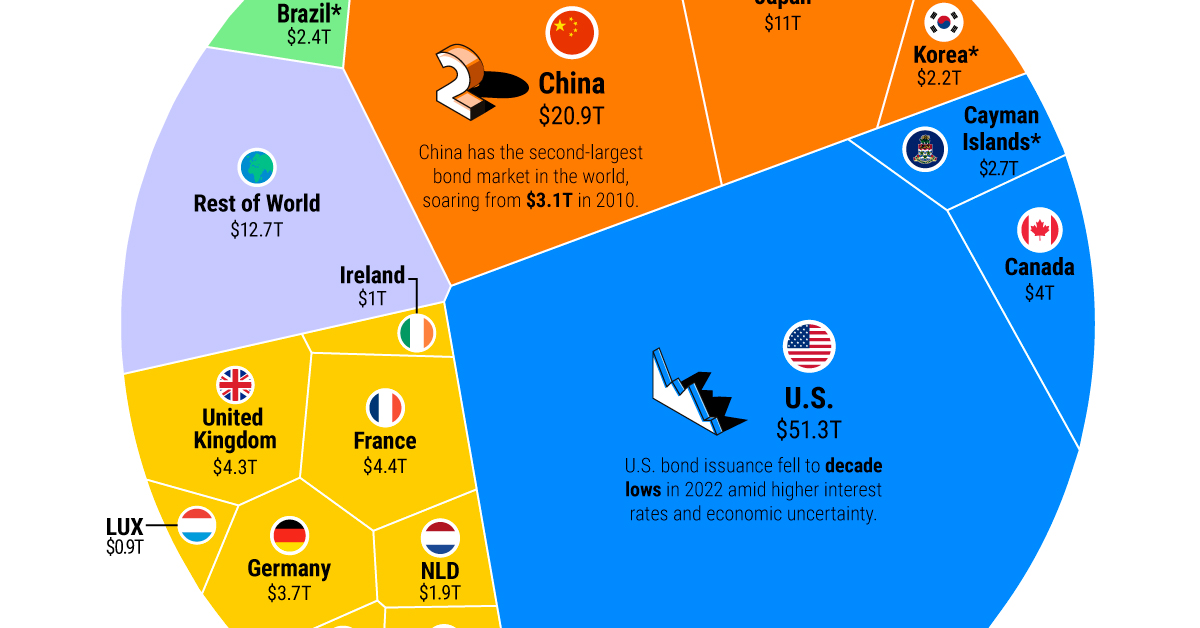

Ranked: The Largest Bond Markets in the World