Lululemon Sees Annual Sales, Profit Below Estimates on Weaker Accessories Demand

$ 27.50 · 5 (93) · In stock

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/businessoffashion/IZVBAZO4OBDMPM7BSWSIYJCE5Q.jpg)

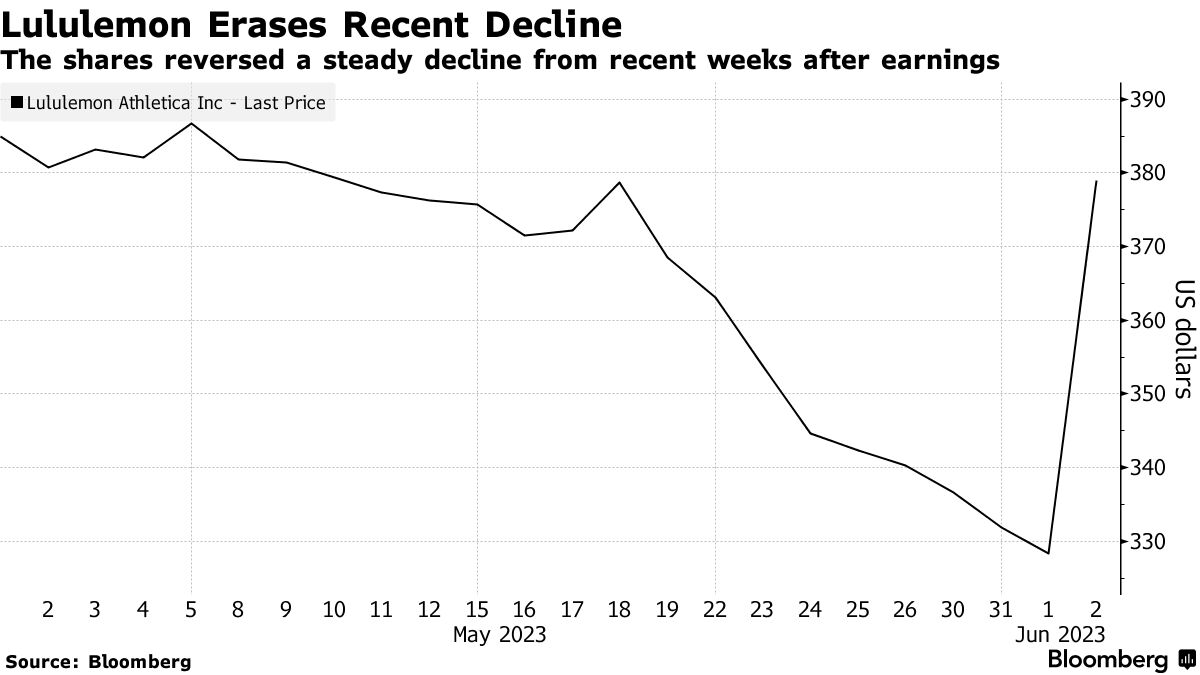

Shares of the Vancouver, Canada-based company fell 9 percent in extended trading.

Lululemon sees annual sales, profit below estimates on weaker accessories demand

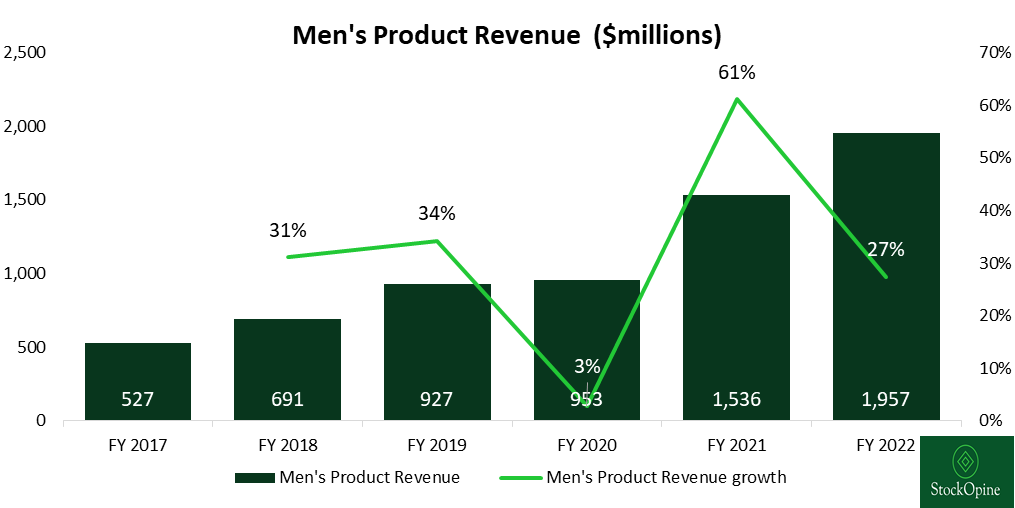

Lululemon vs under armour business strategy analysis

:quality(70):focal(-5x45:5x55)/cloudfront-eu-central-1.images.arcpublishing.com/businessoffashion/SORFVRVYZVDGNGGIBGL7TEEC7Q.jpg)

Read Laura Larbalestier News & Analysis

:quality(70):focal(-5x45:5x55)/cloudfront-eu-central-1.images.arcpublishing.com/businessoffashion/7MQC536Z4NHJJNQUWU6T7I2GFQ.jpg)

Read Mareva Grabowski News & Analysis

lululemon athletica Inc. : Hesitation should subside in favor of volatility -February 27, 2018 at 01:47 pm

Lululemon Earnings Beat Estimates as Upscale Demand Holds Up (LULU) - Bloomberg

Lululemon's Strong Fiscal 2022: A Sign of Resilience in Athleisure Industry

Which Apparel Brands Lived Up to the Sector's Strong Holiday Sales?

Nike, Lululemon sales rise in China while luxury spending sputters in the US

Lufthansa 'on track' for launch of regional City Airlines

Lululemon sinks after U.S. consumer retreat spurs weak outlook - BNN Bloomberg

Lululemon raises annual forecasts for second time on buoyant demand - The Globe and Mail

Lululemon sees annual revenue below estimates on weaker demand

Chart: Lululemon Athletica: The Upward-Facing Stock

:quality(70):focal(-5x45:5x55)/cloudfront-eu-central-1.images.arcpublishing.com/businessoffashion/LCF2DIXMHRBGBKYKJGYJTBGMOQ.jpg)

Read Jeremy Allen News & Analysis